Industry 4.0, Proximity Restrictions and Sustainable Development

Funding: This work was supported by the Eusko Jaurlaritza (GIC 21/113).

ABSTRACT

The influx of digital technologies raises a need for technological adaptation that affects all of the manufacturing industry. The role of external entities will be especially relevant in facilitating the company's adaptation processes. Moreover, the widespread use of digital technologies in creating innovative solutions accelerates the need for adaptation processes, thus reinforcing ongoing dependence on external contexts for these initiatives. Within a cognitive framework where tacit knowledge is pivotal, there will be a need to reinforce the intensity of proximity constraints. Adaptation is bound to have very powerful territorial effects. This paper delves into the territorial challenges that emerge when digital technologies are integrated into the knowledge bases of the manufacturing industry's product fields. It examines two key dimensions: the proximity constraints that stem from the information flows between entities related to innovation goals, and how they affect decisions on business operation locations and explain the clustering of production in specific areas. Our study highlights the significant territorial effects resulting from the widespread adoption of Industry 4.0. This trend leads to the concentration of productive activities within highly technologically advanced areas and prompts reshoring processes. The geography of production is set to undergo profound transformations, yielding substantial impacts on sustainability. By repatriating or regionalising productive activities, production moves closer to developed markets, which notably reduces the ecological footprint. This shift is promoting greater sustainability in value chains and supports the adoption of a circular economy approach.

1 Introduction

Businesses and industries are actively reconfiguring global value chains (GVCs), as they develop new mechanisms to create and capture value on a global scale (Gereffi et al. 2005; Dachs et al. 2019; Awan et al. 2022; Bilbao-Ubillos et al. 2024; Szalavetz 2024). An ecosystem perspective on GVCs (Schmidt et al. 2021) encompasses not only the network of activities leading to the production of goods and services, focusing on the location of these activities and the interactions between participating actors (Gereffi et al. 2005), but it also includes non-traditional actors, such as research institutions and governments, thereby broadening the perspective on GVCs (Teece 2011).

Technological adaptation is bound to have very powerful territorial effects because of the territorial constraints linked to the adaptation process itself. However, economic literature has often overlooked these effects when examining the impact of changes in the GVC due to the widespread implementation of Industry 4.0 technologies (I4.0T). Orzes and Sarkis (2019) acknowledge that the link between reshoring, or the reconfiguration of global supply chains, and environmental sustainability remains largely unexplored. However, as Strange and Zucchella (2017) point out, the emerging digital technologies driven by I4.0 have significant potential to disrupt the organisation and location of activities within GVCs, as well as influence who benefits from the added value in these chains.

This paper delves into the territorial challenges that emerge when digital technologies are integrated into the knowledge bases of the manufacturing industry's product fields. It examines two fundamental dimensions: the proximity constraints that stem from the information flows between entities related to innovation goals, and how they affect decisions on business operation locations and explain the clustering of production in specific areas.

From an evolutionary perspective, technical solutions can be seen as unique cognitive combinations. Accordingly, they define distinct areas of knowledge that develop over time, aiming to improve their features cumulatively, with learning processes playing a pivotal role (Breschi and Malerba 1997; Lundvall 1992; Dosi 1982; Foray 2000; Dosi and Nelson 2011; Bilbao-Ubillos et al. 2023).

Thus, the challenge of adaptation will be unique to each firm and must address the cognitive demands that arise from its transition to Industry 4.0, leveraging the available technological resources. In order to carry out this adaptation and bridge the cognitive divide, the plant will need to draw on (a) the resources that constitute the firm's technological potential; and (b) the technological resources that are likely to be outsourced (technological context).

The role of the external context will be particularly significant, given that we are analysing the adaptation issues related to a scientific body of knowledge that stands apart from the other knowledge forming the technical solutions used by the firm. External sources are essential for addressing two technology-related needs within firms: on one hand they allow firms to acquire external information that enriches their potential, and on the other, they aid in forming collaborative links with external bodies to conduct joint research projects, leading to new developments and ultimately to new products and processes.

The technological context plays a vital role, acting both as a source of cognitive resources constrained by proximity that the firm needs to integrate, and as a local setting for providing additional technology with industrial applications. This is an important consideration, given how swiftly the digital technologies sector can generate new and increasingly sophisticated applications. These conditions favour the agglomeration of productive activities and the reversion of previous offshoring decisions, a phenomenon known as reshoring.

While digital technologies are a highly effective tool for the exchange of information among interacting actors, they do not remove the proximity constraints that affect these transfer processes. Proximity constraints are connected to the cognitive attributes of the information being exchanged and are especially influenced by the significance of the tacit knowledge content involved. A significant influence is in the knowledge of scientific basis and high degree of novelty that shape the current of new digital developments.

On the other hand, as noted by Moser (2024), the concept of sustainable manufacturing is anchored in producing manufactured goods through economically viable processes that limit waste, while taking into account the three ESG pillars: environmental, social, and governance. Moser (2024) suggests that reshoring has the potential to cut decarbonisation by 25%–50%, put an end to human rights abuses in offshore production facilities, and, by manufacturing closer to the markets they serve, produce less waste.

In this paper, we aim to link the gradual adoption of Industry 4.0 technologies with the reshoring processes, which in turn positively impact the sustainability of value chains.

The work undertaken followed two complementary methodological approaches: the first was theoretical, and the second focused on applied research. During the initial phase, we conducted an exhaustive review of the literature and engaged in extensive theoretical reflection on the relevant aspects of the research object and the connections between phenomena. This effort aimed to contextualise the study, identify knowledge gaps, specifically the territorial implications of using new digital technologies in terms of potential reshoring, and to establish a solid conceptual framework for analysis. In the subsequent phase, data gathered from a detailed field study conducted in the Autonomous Community of the Basque Country (ACBC) in Spain between December 2023 and February 2024 was then used to test the main theoretical assumptions established in the initial phase. This included 24 in-depth semi-structured expert interviews with senior executives and industry authorities holding extensive knowledge of the present conditions in the automotive sector. Interviews lasted 60–100 min.

We visited 19 manufacturing firms, selected according to their size, locally sourced funding—believed to afford them decision-making autonomy—their participation in international value chains, and their technological importance. The pool of interviewees was then expanded to include 5 specialists from advanced manufacturing technology centres (Teknalia) and from cluster organisations (IMH, AFM-Clúster, ACICAE, SERNAUTO), which encompass hundreds of companies within the sector (Bilbao-Ubillos et al. 2025).

The paper is structured as follows: In Section 2, we begin by outlining the theoretical arguments that provide guidance for our study. In Section 3, we analyse the proximity restrictions arising from the technological adaptation process to industry 4.0. In Section 4, we connect the proximity restrictions to reshoring processes. Section 5 outlines new sustainability drivers emerging from changes in production and regulatory dynamics. Lastly, we draw a few conclusions regarding academic contributions and managerial learnings.

2 Theoretical Framework

Our analysis of the technological adaptation processes within the framework of industry 4.0 begins with an understanding of technical development solutions as a synthesis of scientific knowledge from various fields. This technical solution will materialise a process designed to achieve a technical objective in terms of product design. Each technical solution implies a distinct cognitive combination and, in this sense, defines a unique field of knowledge that will evolve, seeking to enhance its performance according to a cumulative evolutionary dynamic in which learning processes play a fundamental role (Manoury 1968; Lundvall 1992; Edquist 1997; Dosi 1982; Dosi and Nelson 2011; Foray 2000). The nature of the knowledge base of an industry will shape the patterns of the trajectory of its technical progress (Breschi and Malerba 1997; Breschi et al. 2000; Dosi et al. 2006; Marsili and Verspagen 2002; Bilbao-Ubillos and Camino-Beldarrain 2021).

This perspective requires giving preferential attention to the analysis of the cognitive problems that arise in each product field, factoring in the essential organisational knowledge for coordinating the operations of value chains. A vision that references, on one side, the literature on Innovation Systems, underscoring the crucial role of the external context in explaining a firm's innovation dynamics, and on the other side, the Cognitive Economy literature, which examines how cognitive distance influences the exchange and assimilation of technological information. In this context, geographical distance and innovation are related (Nooteboom 1999, Nooteboom 2010; Moodysson et al. 2008) and the determining factors of proximity restrictions that affect adaptation processes are identified (Davids and Frenken 2018; Carrincazeaux 2009; Asheim et al. 2007; Mattes 2012; Torre 2008; Torre and Rallet 2005; Storper 1992, 1998). One particularly relevant aspect in the domain of digital technologies is its immense re-combinatorial potential, which greatly values proximity for generating new evolutionary possibilities (Foray et al. 2011; Foray and Goenaga 2013).

The body of literature that analyses industrial dynamics in the context of the digital economy will help us identify the specific cognitive requirements arising from the main evolutionary trends put forward by Industry 4.0, primarily servitisation (Ardolino et al. 2018 ; Vendrell-Herrero et al. 2021; Zheng et al. 2019; Niu and Qin 2021; Paiola et al. 2022). Finally, we will leverage the outcomes of our analysis to assess the potential effects of emerging production trends through the lens of the circular economy (Bressanelli et al. 2018, 2020; David et al. 2021; Kolagar et al. 2022).

2.1 The Cognitive Issue in the Processes of Adaptation

- The cognitive complexity of the supporting knowledge bases inherent to each product field.

- The degree of novelty of product fields.

2.1.1 The Technological and Combinatorial Complexities of the Supporting Knowledge Bases in Each Product Field

Technological complexity helps identify the scientific nature of the knowledge that supports a technical solution, and thus the significance of its tacit component. By contrast, all technical solutions are necessarily the result of a convergence of knowledge from different fields, which is used to create a product or process. In turn, this convergence of knowledge defines a unique knowledge field of its own, assigned a degree of combinatorial complexity determined by the number of various knowledge fields that converge within it.

The greater the combinatorial complexity, the more intense, complex, and specific the investigative efforts must be. Knowledge from different fields must be rendered compatible in the pursuit of a preset technical goal. For instance, one can easily imagine the difficulties involved in incorporating electronics into a product field with a high degree of combinatorial complexity, such as the automotive sector. Considerations must include interference with other electromagnetic fields, induction in the electrical system, and interfaces with mechanical and electromechanical devices, among other factors. Moreover, the more specialised the knowledge needs to be, the greater the technological distance between it and other activities widens (Nooteboom 2010) and the more it relies on its own internal technological resources to fuel the dynamics of innovation.

In the manufacturing industry, the application of new digital knowledge and the resulting integration of digital applications into product fields increase the combinatorial complexity of the associated knowledge bases. The newly integrated knowledge is often cognitively very distant from what has previously been handled, presenting a challenge for adaptation. In many cases, firms need to establish a research environment that enables them to align their technological potential with the new cognitive requirements brought about by incorporating digital technologies into their designs.

2.1.2 The Degree of Novelty of Product Fields

The variable ‘degree of novelty of product fields’ signifies how accumulated knowledge over the lifespan of a product or process field impacts technical creation processes (Foray 2009; Czarnitzki and Thorwarth 2012; Foray and Lissoni 2011).

The early stages are marked by considerable instability in cognitive knowledge bases as a result of the fundamental role initially played by the scientific principles that give rise to the relevant product field. While these stages are challenging to formalise (Niosi 2000; Rotolo et al. 2015), the crucial role of basic knowledge underscores the significant influence of the tacit component in knowledge transmission and the rapid obsolescence of designs. Early stages involve many new elements in all areas of business operations—such as human resources, technology services, and raw materials—each of which has territorial implications.

As the degree of novelty decreases (as information is built up via R&D work to improve products and processes), the cognitive bases of designs become increasingly stable, resulting in technology dynamics focused on improvement tasks (Utterback 2001). At this point, the knowledge transferred is largely codified, reducing the need for proximity to ensure efficient technological interactions.

The spread of digital technologies in the field of product manufacturing has led to the incorporation of new, scientifically based knowledge from emerging technologies (Scherngell and Barber 2011) into technical solutions with differing levels of novelty. Therefore, it is important to consider that, in most instances, the technological dynamics within the manufacturing industry inherently include, to some extent, aspects from product fields characterised by a high degree of novelty.

2.2 The Organisational Requirements Necessary for the Firm to Operate Within the Framework of Industry 4.0

Several factors condition the organisational framework:

2.2.1 A Lower Degree of Outsourcing

The heightened uncertainty regarding company operations linked to the shifts in organisational models encouraged by Industry 4.0 is expected to lead towards greater integration of activities in terms of both creative and productive activities.

- –

The extent to which the interdependencies between components can be predicted.

- –

The speed at which the technological cognitive support that is used evolves.

Amid the evolving landscape of digital technologies, the need to collaborate with third parties for the provision of knowledge is inevitable to incorporate expertise that we lack and that resides in fields of knowledge unfamiliar to us. This need will be permanent, given the constant and ongoing influx of new digital solutions. Concurrently, the firm needs to build a robust technical foundation in the digital arena to efficiently assimilate new digital knowledge. This is an essential skill in order to remain in the market and, if we are talking about an end product manufacturer, to control the value chain. In short, we might anticipate a substantial reliance on external technology resources, aligning with an internalisation of manufacturing tasks. Despite predictions of disruptive change, the relative stability of the industrial architecture is a conceivable scenario (Szalavetz 2024).

2.2.2 The Organisational Model Governing the Value Chain

The ongoing penetration of new digital advancements into heavily automated and flexible processes and into smart and highly customised products will be generating continuous changes that will affect not just the production system but also the business model, as a result of a clear trend towards servitisation (Davies 2015; Dhéret 2016; Neely 2013). In turn, the industry's structure is evolving towards a networked firm organisation, marked by more agile and adaptable market responses.

This will facilitate customised production and deeper integration with customers and suppliers on platforms that have a growing need for qualifications, as well as robust telematic infrastructures providing support for new operational demands (Liu et al. 2019; Wang et al. 2022). The changes in individual qualifications must make organisational learning possible; this process of acquiring knowledge allows organisations, as repositories of this expertise, to materialise routines and practices that will shape internal relationships (Dosi and Marengo 2007) and enrich the experience of management teams (Beckman and Burton 2008).

The characteristics of the organisational model fundamentally affect production activities that are systemically integrated within segmented value chains. The value chain is understood as a network of relationships between different hierarchically linked companies. Its operational efficiency relies on a body of knowledge developed through learning that takes place within the relational sphere (learning by interacting, Lundvall 1992). This knowledge is essentially tacit and highly specific to each particular relationship and is held by the plants engaged in these relationships.

Relational learning through business collaborations produces knowledge that is unique and specific to each relationship, increasing operational efficiency across the supply chain and conditioning the competitive standings of the participating companies. To the extent that plants are the repositories of this learning, those that develop a more intense relational component in their operations have a favourable argument for consolidating their position in the value chain they engage with. Considering the enormous possibilities that new digital developments offer in facilitating increasingly efficient logistics solutions (Chen and Kamal 2016), the competitive significance of this knowledge for plants engaged in rigorous logistics relationships becomes evident.

The constant supply of new digital solutions leads to constant organisational changes, which, to retain competitive value, must align with the organisation's ability to adapt work structures and employee cognitive profiles to new processes (Hirsch-Kreinsen et al. 2019) and exploit the business opportunities presented by an evolving landscape (Weking et al. 2020).

2.3 Proximity Constraints in Adaptation Processes: Determining Factors

The relevant literature points to three basic conditioning factors that influence the proximity needs of actors based on technology-related reasons (Davids and Frenken 2018; Carrincazeaux 2009; Asheim et al. 2007; Torre 2008):

2.3.1 The Information Content of the Technology Flows Transferred

As the tacit component of the knowledge transferred between related entities increases, so does the need for physical proximity (physical contact) to ensure effective knowledge transfer. The more tacit the content, the more challenging it is to access the knowledge. If information is perfectly codified, then the distance between actors becomes irrelevant. Synthesis with digital technologies implies a convergence of scientifically based knowledge with a high tacit component, thereby imparting this aspect to the synthesis as well (Asheim et al. 2007; Davids and Frenken 2018). This is a basic scenario, bearing in mind the need for manufacturing firms to rely on external resources to incorporate digital applications into their products and processes.

2.3.2 The Frequency of Interactions Required by Innovation Processes

As the number of relationships created to carry out an innovative project increases, so does the need for proximity among participating actors (Carrincazeaux 2009). This applies especially to systemic designs.

2.3.3 The Dynamic Nature of Innovation Processes

The dynamic development of products and processes means that cognitive and resource-related needs change over the course of their lifespan in ways that are very hard to predict. A company is aware that it will need knowledge, special materials, technology services, and human resources with specific characteristics and qualifications going forward, but cannot determine exactly what those needs will be. Businesses seek to protect themselves against this uncertainty in regard to future needs by locating in areas where they are more likely to be met (Bilbao-Ubillos et al. 2024). Location incentives increase as the pace of change in technology speeds up, and the cognitive distance to the resources that need to be incorporated becomes greater (Castellacci 2008).

This point is vital for this study, bearing in mind the plethora of new solutions that digital technologies can generate in all directions and how rapidly the range of possibilities that they offer can change. This, in turn, means that developments soon become outdated as a new generation of even more efficient applications swiftly replaces existing solutions. This highlights the pivotal role of the ‘future needs’ argument in explaining the locations chosen by businesses and, by extension, the production clusters associated with Industry 4.0.

3 Territorial Proximity Constraints Associated With the Technological Adaptation Process

The dynamic characteristics of technology presented by Industry 4.0 stem from the advanced technical complexity of the solutions that digital technology developments use themselves, and the pace at which the composition of these solutions changes. This increases the intensity of proximity constraints in their technological relationships with external organisations (Carrincazeaux et al. 2001).

Additionally, the prolific nature of digital technologies in producing innovative solutions increases the frequency of adaptation processes, thereby perpetuating the continual reliance on external contexts for such endeavours. Within a cognitive framework where tacit knowledge is pivotal, there will be a need to reinforce the intensity of proximity constraints. This is a change of pace that makes the cognitive and resource needs very difficult to predict along the evolutionary path of a product field.

As they look for technical contexts that can offer a vast supply of resources, we can expect the technological adaptation processes in Industry 4.0 to have very powerful territorial effects and, consequently, to reinforce the processes of production clustering.

In a descriptive analysis of the proximity restrictions that affect the different cognitive flows involved in the technological adaptation processes, we can say the following:

3.1 The Provision of Human Resources

For manufacturing firms engaged in Industry 4.0 activities, the most significant requirement is the change in the cognitive profiles of human resources. There will be a need for new qualifications and specific knowledge, along with a new typology of creative skills and entrepreneurship, greater versatility in human resources, and a more prominent emphasis on digital expertise (Smith and Anderson 2014; Brettel et al. 2014). Figure 1 shows the main skills gap identified by interviewed experts that need to be addressed in order to meet the challenges posed by Industry 4.0. During our fieldwork, participants were asked to assess several skills, using a scale from 1 to 6, with 1 being not at all sensitive and 6 being very sensitive.

As shown in Figure 1, the most valued skill shortages are technology design and programming, leadership and social influence, complex problem-solving, and analytical thinking and innovation (4 out of 6).

We need to highlight not only the changes in the qualifications required for work in Industry 4.0, but also the limitations posed by its mobility. Human resources mobility is difficult to delimit as it is also conditioned by factors that are not purely technological. First, the firm's ties with its local community will be relevant, in addition to the social, cultural, and other contexts in which it is located, which function as factors of attraction (Castells and Hall 1994). Second, the firm's appeal as a workplace destination in which to build a professional career will be important. Large manufacturing firms and those with a higher technological potential are more likely to be attractive to skilled workers than smaller firms with lower technological potential (Bilbao-Ubillos et al. 2021a). When we consider the broad mobility limitations affecting human resources and add the fact that most workers will need new qualifications, it becomes clear that the fundamental factor will be the ability of the external context, near the plant, to provide human resources with the required profiles (Strange and Zucchella 2017).

The fundamental importance of the qualification of human resources highlights the need to push forward new mechanisms aimed at facilitating the mobility of qualified personnel from context providers (universities and technological centres) to firms, through different forms of temporary stays or part-time contracts which would facilitate an efficient technological adaptation at a reasonable cost for lower potential firms. These adaptable frameworks offer a chance to leverage the available qualifications of human resources within the context, which is vital given their role as a key localisation factor (Bolter and Robey 2020; Raza et al. 2021).

The literature provides many examples of the role of human resource provision as a location factor. Freeman Schwabe Machinery cited faster market access and a greater pool of skilled workers as reasons for relocating operations from Taiwan to Cincinnati, Ohio. Similarly, according to the company, Ford's decision to relocate its hybrid transmission plants from India and its battery pack facilities from Mexico is driven by an aim to improve innovation processes and address difficulties in finding qualified personnel (Moser 2013). ‘Fine Scandinavia’, part of the Konga Mekaniska Verkstad AB group, despite possessing a strong internal technological potential that allowed for the incorporation of digital applications in the design of its components, in 2018, relocated certain product lines it was manufacturing at its Vietnam facility to its Anderstorp headquarters. This decision was based mainly on the availability of highly skilled labour in the Anderstorp region (Mellergårdh 2018). Ford Motor Company aimed to gain greater control over design and production engineering, along with access to skilled workers, by moving the assembly of its F-Series pickup trucks from Mexico to Ohio (Bals et al. 2016). Research focusing on Industry 4.0 through case studies confirms the link between digital servitisation and the availability of qualified and skilled human resources in specific locations (Lampon and Gonzalez-Benito 2020; Moradlou et al. 2022).

3.2 The Supply of Technological Services and Consultancy in the Field of Digital Technologies

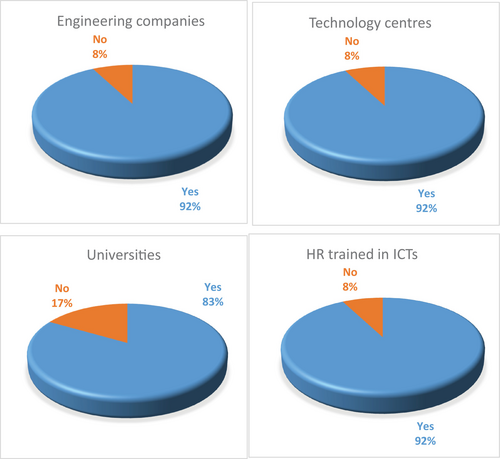

We refer to a highly diverse fabric composed of various firms and institutions offering a wide range of technological advisory and consultancy services, which have a beneficial impact on their customers' technical and organisational transformations (Wood 2002). We gathered all organisations that would have an explicit role in coordinating or connecting agents, or independently acting as knowledge disseminators, including technology centres, engineering companies, technical assistance companies, and digital services companies. Figure 2 illustrates the extensive use of external digital resources in the context of the interviewed company's location.

In recent years, 92% of the companies participating in the study had drawn on technology centres, HR trained in ICT, and engineering firms in their vicinity as resources. For universities, the figure stood at 83%.

Therefore, the activities undertaken by these entities, equipped with technological and targeted capabilities to fulfil customer needs, are essential, particularly for companies with lower potential and a limited ability to connect with leading technological institutions.

Konttinen et al. (2010) insist on the need for policy interventions in order to encourage the establishment of such institutions when the relationships between firms and universities or technological centres are ineffective.

There is a need for organisations capable of performing these knowledge dissemination tasks, which can come in many different institutional forms, from private advisory firms to formal entities such as technological centres that can achieve these goals.

The presence of clusters, which unite firms engaged in a specific product field, serves as a tool with enormous facilitating potential for technological adaptation processes. It defines a consortium of firms that create an optimal setting for implementing programmes related to technology transfer, business collaboration, internationalisation, and similar endeavours aimed at enhancing competitiveness. The cluster organisation creates a forum particularly well-suited for facilitating the supply of technological services and fostering inter-firm relationships of interest to the partners, which is especially relevant for firms with a lower technological potential (SMEs) (Hernández et al. 2013). It also constitutes a uniquely qualified platform capable of building relationships with institutions and individuals beyond the cluster (Carrincazeaux et al. 2008).

The literature examining reshoring processes is very useful in justifying the need for technological infrastructures that provide technological services in understanding decisions about localisation (relocation).

Pearce II (2014) analyses backshoring among firms in the USA. NCR Corporation is to move production from China to Georgia (USA) to seize the advantages offered by the latter location in terms of technology infrastructures. Dachs et al. (2019) study a sample of 1705 firms from Austria, Germany, and Switzerland. They confirm that the rise of Industry 4.0 has accelerated the trend of backshoring. An important reason for this shift is the infrastructure issues that arise when companies prioritise increases in productivity and quality.

3.3 Customer and Supplier Relationships, and Proximity Constraints

The new context of Industry 4.0 intensifies customer-supplier relationships both in the field of product conception and development, as well as in the logistics of merchandise circulation.

The vast potential of digital technologies for generating new applications across different domains indicates that they are expected to evolve rapidly, offering new, more efficient, and more comprehensive practical options, continuously requiring technological adaptation (Niosi 2000). Moreover, incorporating digital technologies on a large scale in designing the factory of the future results in a ‘smartisation’ of products and processes. This is likely not only to enhance the efficiency, seamlessness, and flexibility of product design and improve the quality, precision, and performance of products but also to drive the offering of new services associated with conventional manufacturing operations (Dhéret 2016). Firms are now in a position to offer the market an increasing range of value propositions that are integrated into service bundles, including maintenance, consultancy, training, functional upgrades and updates, performance and wear monitoring, back-office support and more. They can also foster closer ties with customers, offering them guidance and support in utilising the supplied goods. In turn, this undoubtedly promotes customer loyalty and cultivates a rapport between customers and suppliers, which feeds back into the cycle of (re)designing goods (Kamp 2016). Customised production makes proximity to markets and customers relevant (Pegoraro et al. 2022).

Servitisation processes also strengthen technological links among actors who must incorporate new applications within their overall designs and maintain ongoing cooperation. This enables them to assimilate the new developments provided by digital applications and coordinate the flow of goods between participants, establishing a collaborative environment (Marilungo et al. 2017), which allows suppliers, customers and other stakeholders to become integral parts of a network ecosystem set up around cyber-physical systems (Thoben et al. 2017).

In addition, the new knowledge derived from digital applications is science-based and characterised by considerable novelty (latest generation), so it can be expected to contain a large tacit component. This is likely to involve proximity constraints for efficient transfer (Bilbao-Ubillos et al. 2021b).

Japan's Yaskawa Electric Corporation moved its electric motor plant to be closer to its customers in the USA, seeking advantages in customisation and faster deliveries to improve customer service. Caterpillar also explained the transfer of its tractor production from Japan to Victoria (Texas) citing the need to be close to consumers (Pearce II 2014). The business models used will call for increasingly higher levels of skill and qualifications from both customers and suppliers, as well as powerful telematic infrastructures, both public and private, to support new operational requirements (Liu et al. 2019; Wang et al. 2022). Consequently, maintaining physical proximity among stakeholders becomes essential to ensure rapid responses and to gain vital insights into customers' operations and needs (Strange and Zucchella 2017). It also requires customers and suppliers to be located in a setting where the technology resources needed to take part in an integrated, advanced process are available (Sjödin et al. 2021).

4 Proximity Restrictions and Reshoring

Integrating digital knowledge involves the dual challenge of engaging with new technologies and fields of knowledge unfamiliar to the firm, thus highlighting the significance of its tacit content and, ultimately, the intensity of the proximity constraints that affect its transfer.

The role of external entities will be especially relevant in facilitating the company's adaptation processes. The constant flow of new digital developments determines the fundamental role of the external context as a source of technology. This reliance imposes strong proximity constraints arising from both the prominence of the tacit content of the knowledge being shared and the enormous difficulty of predicting in advance the ‘technological needs’ that companies may have. These conditions explain why companies choose to locate their activities in contexts of high technological potential (Bilbao-Ubillos et al. 2024).

The need to incorporate new, specific resources required by new products and processes, achievable via different mechanisms such as technology services, next-generation materials, cooperation with customers and suppliers, and workers with specific skill sets, all subjected to strong proximity constraints, strengthens the rationale for locating in contexts of excellence that cater to the demands of new product fields. This explains why those production activities are clustered.

The new context of Industry 4.0 intensifies customer-supplier relationships, increasing proximity restrictions between linked companies and reinforcing the processes of geographic agglomeration of productive activities in the most technologically developed contexts, with the densest productive fabric and the best technology centres and universities.

- –

The search for contexts with a wide technological offer.

- –

The search for proximity to customers and suppliers to enable the efficient development of increasingly complex and intense relationships.

Functioning within the Industry 4.0 framework establishes a production scenario that favours concentration processes in areas with high technological potential, thereby boosting the process of reshoring plants that were initially set up in areas with less technological potential, in pursuit of reduced operational costs, mainly wages.

- –

The increase in transport costs and exchange rate risks;

- –

The recent resurgence of protectionist policies that hinder the trade flows inherent in the globalisation of value chains;

- –

The increased risk of supply disruption (pandemic);

- –

The slow but steady trend of wage convergence in typical FDI destinations (Asia and Eastern Europe) towards the levels seen in the investment source countries;

- –

The perception that certain activities, due to their strategic value, should be located within national borders;

- –

Other deterrents to offshoring include rising freight costs, natural disaster threats, and the dangers posed by political instability.

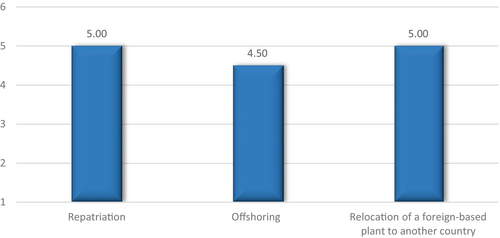

Figure 3 illustrates the impact of Industry 4.0 technologies on company location, according to the expert assessments gathered during the fieldwork. Again, participants were asked to assess three possible decisions, using a scale from 1 to 6, with 1 being not at all sensitive and 6 being very sensitive.

The options of repatriation (reshoring) and relocating a foreign-based plant to another country were the most highly valued, both scoring 5 out of 6, while offshoring received a score of 4.

Moreover, the literature provides conclusive evidence of the rising importance of reshoring: in 2020, the US saw an increase of 1484 companies relocating, setting a record with 109 000 jobs created and raising the total number of jobs announced since 2010 to over 1 million. Europe recorded 253 reshoring cases during the period 2015–2018, with an estimated total employment impact of 12 840 jobs.

Empirical evidence from the last decade highlights an upward trend in these processes (Raza et al. 2021; Dikler 2021; Ma 2020), with larger firms and medium- and high-tech industries exhibiting the highest propensity for reshoring (Raza et al. 2021). As a result, manufacturing that requires adequate infrastructure, skilled workers, intellectual property protection, and integrated supply chains finds domestic production to be the least costly and most efficient option (Bolter and Robey 2020).

5 Overall Sustainability Implications of Changing GVCs

Digital technologies (DTs) are viewed as drivers that can promote a more sustainable supply chain management (Birkel and Müller 2021; Strange and Zucchella 2017; Sanguineti et al. 2023). Stoddart (2011) defined sustainability as the efficient and equitable distribution of resources both within and across generations, while ensuring socio-economic activities are conducted within the confines of a finite ecosystem. This concept includes economic, social, and environmental aspects.

Over several decades, the reduction of trade barriers has enabled firms to offshore to predominantly developing countries offering substantial savings on labour and raw material costs, as well as access to valuable resources, technology, skills, and knowledge (Ashby 2016). To gain strategic advantages and optimise processes, the various stages of value creation were located in different countries. The GVC framework provides a thorough understanding of how value was captured, sustained, and leveraged (Gereffi et al. 2005). However, the new constraints for GVCs stemming from I4.0T and the increased environmental awareness among the population and policymakers are driving sustainability performance.

One aspect is the mentioned tendency to repatriation or regionalisation of productive activities brings production nearer the markets of developed countries. This significantly reduces the ecological footprint and promotes greater sustainability within value chains.

There is further evidence indicating that the introduction and implementation of I4.0 technologies are important in supporting the adoption of circular economy (CE) practices (Bilbao-Ubillos et al. 2025). Numerous studies highlight the significance of the Internet of Things (IoT), Big Data and cyber-physical systems (CPS) as essential facilitators for implementing circular strategies, such as recycling and reuse in smart supply chains (Ćwiklicki and Wojnarowska 2020; Montemayor and Chanda 2023). Likewise, Big Data can be used to forecast product returns, aiding the planning of remanufacturing operations and the effective scheduling of logistics (Bag and Pretorius 2022). Alongside IoT and Big Data, other studies include additive manufacturing and artificial intelligence as the primary technologies promoting the implementation of the CE (Lei et al. 2023; Rosa et al. 2020).

In their work, Pathak and Verma (2025) identify the adoption of government regulations as the sixth primary driver facilitating the successful integration of sustainability into manufacturing. Coercive pressures stemming from stricter environmental policy standards play a critical role in the CE (Mont et al. 2017). Political elements include guidelines and regulations, such as taxes, support funds and subsidy policies (Hina et al. 2022). The availability of recycled materials is also a driver for reshoring (Ashby 2016).

Finally, as highlighted by Samuel (2025), carbon pricing mechanisms, including carbon taxes and emissions trading systems, have emerged as critical tools for mitigating environmental impact while encouraging industries to adopt cleaner technologies.

All these dimensions are instrumental in shaping the techno-geographic decisions of firms, generating significant impacts on sustainability.

6 Conclusions, Academic Contributions, Managerial Learnings, Limitations and Future Research

6.1 Conclusions and Academic Contributions

The progressive implementation of Industry 4.0 technologies emphasises the importance of agglomeration economies and reinforces the concentration of productive activities in the most technologically developed contexts, with the densest productive fabric and the finest technology centres and universities.

- –

Due to the significant proximity constraints on knowledge transmission when developing new technical solutions with digital inputs, there will be a need to identify contexts that can provide these necessary resources, contexts that will need to supply human resources with new qualifications and offer training resources in new areas.

- –

The heightened intensity of interactions among agents participating in the new production scenario means that proximity between the actors (consumers, companies supplying raw materials, services, new materials, etc., and customers) is crucial.

The profound changes in the geography of production will have significant effects on sustainability. A key outcome resulting directly from the aforementioned trends would suggest that the repatriation or regionalisation of productive activities brings production closer to developed countries' markets, notably reducing the ecological footprint and promoting greater sustainability within value chains. In addition to reducing the necessity for transporting components from remote nations, a higher concentration of production in environments with advanced technological capabilities benefits processes linked to the circular economy (Fratocchi and Mayer 2023).

But reshoring (repatriation of activities) also implies compliance with more stringent environmental regulations (encouraging the adoption of more environmentally friendly production processes) and the implementation of other sustainable practices in the supply chain, such as reverse logistics for recycling (Sirilertsuwan et al. 2018). Moreover, the findings would underscore the importance of more informal governance and socially complex, long-term relationships in the development and management of a sustainable supply network (Ashby 2016).

A final conclusion would lead us to confirm that this territorial dynamic could be detrimental to less developed countries (contexts with lower technological potential), causing them to lose comparative advantages and create an international economic scenario in which inequalities would widen.

6.2 Managerial Learnings

Managers must anticipate the specific technological adaptation process for the firm in order to define new products, improve processes or undertake potential diversification strategies in an increasingly competitive environment. They must also be aware of the resources available in each context to meet their technological or human capital needs. For managers of firms that resorted to offshoring manufacturing, the current climate of considerable uncertainty, exchange rate instability, rising environmental awareness, and protectionist trends should prompt a reassessment of whether I4.0T could reduce the localisation advantages for the more labour-intensive phases in developing countries, with reshoring serving as an alternative option.

6.3 Limitations and Future Research

The limitations of the research stem from the difficulty in generalising conclusions due to the unique traits of different manufacturing industries: the greater the technological content of the activities (and hence a higher degree of novelty and combinatorial complexity), the more important the spatial conditioning factors resulting from the new digital applications will become. On the other hand, the intensity of environmental regulations and stakeholders' environmental awareness vary across institutional contexts: In the EU, standards and commitments are more stringent, creating a greater imperative to rethink the value chain.

Identifying the existing gaps in the current literature review highlights the necessity for conducting multiple comparative case studies on firms that have undergone the reshoring process, to better understand the drivers. There is also a need for more research into the relational intensity between companies and surrounding resources, as well as the possibility of replacing physical proximity with digital tools.

Acknowledgements

The authors acknowledge research funding from University of the Basque Country (grant GIU19/078).

Conflicts of Interest

The authors declare no conflicts of interest.

Open Research

Data Availability Statement

The data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions.