The role of social grants on commercialization among smallholder farmers in South Africa: Evidence from a continuous treatment approach

Abstract

This study examined the role of social grants to smallholder producers’ incentives to sell maize marketable surplus. The study used the generalized propensity score (GPS) matching method to analyse the data collected from a sample of 774 smallholder producers in KwaZulu-Natal. The results support the disincentive hypothesis, demonstrating a negative association between social grants and market participation levels of smallholders. The study findings imply that policies aimed at increasing smallholder commercialization should also focus on how to reduce the disincentive effects of social grants.

1 INTRODUCTION

Commercialization of smallholder agriculture has long been recognized as a key mechanism to address rural poverty and stimulate development in developing countries (Alene et al., 2008; Barrett & Swallow, 2006; von Braun, 1995). Smallholder agriculture will have more potential to improve rural livelihoods if it is commercialized (Barrett & Swallow, 2006; Hazell, Poulton, Wiggins, & Dorward, 2010). That is why the commercialization of smallholder agriculture has long been the center of rural development discussions across developing countries (Barrett, 2008).

However, despite the concerted efforts from governments and other development agencies, input and output markets remain inaccessible to smallholders. High transaction costs are identified as one of the key factors curtailing smallholder market participation (Fischer & Qaim, 2012; Hellin, Lundy, & Meijer, 2009; Key, Sadoulet, & de Janvry, 2000). Smallholder farmers fail to cope with the high transaction costs due to liquidity constraints, poor asset endowments, and inadequate access to government support services (Abebaw & Haile, 2013; Alene et al., 2008; Kruijssen, Keizer, & Giuliani, 2009). Furthermore, lack of access to credit is a major source of liquidity constraint among smallholder farmers (Adesina, 2010; Boone, Covarrubias, Davis, & Winters, 2013; Winter-Nelson & Temu, 2005).

Social cash transfer programs have been implemented in South Africa and other developing countries (Barrientos, 2012, 2017; Handa, Davis, & Stewart, 2012; Ulriksen, 2013). The transfers are aimed at addressing the current poverty and improving human capital. However, unintended effects on beneficiary households may ensue. One of the questions that arise is that of the extent to which social cash transfers contribute to the commercialization of smallholder farming in developing countries. Social cash transfers can contribute to the commercialization of smallholder agriculture by relaxing farmers’ credit and liquidity constraints (Barrientos, 2012; Bezu & Holden, 2008; Boone et al., 2013; Tirivayi, Knowles, & Davis, 2016). In contrast, social cash transfers might also result in a culture of dependency and entitlement (Barrett, 2006; Devereux, 2001; Gibson, 2015; Lentz, Barrett, & Hoddinott, 2005). The income effect of transfers reduces the marginal benefit of further income-generating activities (Binger & Hoffman, 1998).

There is a scarcity of literature on the potential linkages between social cash transfers and smallholder agriculture in general and market participation, in particular (see Bastagli et al., 2016 and Tirivayi et al., 2016, for recent reviews). The results are often mixed and inconclusive. Studies conducted in Latin American and sub-Saharan African (SSA) countries show that social transfers have improved asset accumulation, input use, production, and labor use (Boone et al., 2013; Covarrubias, Davis, & Winters, 2012; Radel, Schmook, Haenn, & Green, 2016; Tirivayi et al., 2016; Todd, Winters, & Hertz, 2010). There is also some evidence on shifts from on-farm to nonfarm work among cash transfers recipients (Asfaw, Davis, et al., 2012; Gertler, Martinez, & Rubio-Codina, 2012; Maluccio, 2010), as well as increased investments in microenterprises (Gertler et al., 2012; Handa, Seidenfeld, Davis, Tembo, & Zambia Cash Transfer Evaluation Team, 2016; Todd et al., 2010).

The evidence on the impact of social transfers on incentives to allocate labor to on-farm and off-farm activities is of mixed nature. Whereas some studies (e.g., Edmonds & Schady, 2008; Foguel & Paes de Barros, 2010) found no significant relationship between social transfers and household labor supply, others (e.g., Ardington, Bärnighausen, Case, & Menendez, 2013; Ardington, Case, & Hosegood, 2009; Posel, Fairburn, & Lund, 2006) reported increases in labor supply. The results from other studies (e.g., Abel, 2013; Asfaw, Pickmans, Alfani, & Davis, 2016; Bertrand, Mullainathan, & Miller, 2003; Sinyolo, Mudhara & Wale, 2017a) show unintended negative effects, reporting that social transfers reduce incentives to work.

The theoretical linkages and empirical relationship between social cash transfers and smallholder commercialization have not been systematically articulated. Understanding the theoretical and empirical relationship between social transfers and smallholder commercialization can improve the design of rural development policy interventions (e.g., Boone et al., 2013; FAO, 2016; Tirivayi et al., 2016). This, in turn, can create synergy between social cash transfers and poverty reduction through enhanced agricultural productivity and production (Gibson, 2015; Maluccio, 2010).

This study aims to address these gaps in the literature, focusing on the interlinkages between social grants and smallholder market participation. The empirical results from South Africa should be useful for other countries, as social cash transfers are common interventions throughout the developing world. This study contributes to the literature in three ways. First, it examines the potential impact of social grants on commercialization levels of smallholder farming, focusing on market participation among maize producing smallholders in South Africa. Maize is the main staple crop that smallholder farmers in South Africa and other developing countries produce (D'Haese et al., 2013). Evidence suggests that poverty reduction in SSA requires prioritization of staple crops (Boone et al., 2013; Larson, Muraoka, & Otsuka, 2016; Lipton, 2005). Second, the study went beyond taking impact as homogenous and examined the heterogeneous social grant effects. To this end, this study performed both binary and continuous treatment analyses to understand both the impact of access to social grants and that of the level of dependency on social grants. These two contributions are of global interest.

The third contribution is more relevant to the South African context. Unlike previous studies that mostly focused on the impact of one or a few social grants, or used the income from social grants as the treatment variable (e.g., Agüero, Michael, & Ingrid, 2007), this study used the proportion of income from all the social grants to household income. The study argues that the relative importance of the social grant income influences decision-making behavior in the household. That is why the relative contribution of social grant income (the proportion variable) is a better measure of dependence on social grants rather than the value of social grants income. This study is an improvement on Sinyolo et al (2017b), which assumed homogenous impact. Estimating the so-called “dose-response” and “marginal effect” functions of dependence on social grants enabled us to uncover heterogeneities along different levels of dependence on social grants. These estimations can inform policy on the optimal levels of grant support that could be implemented to reduce the chances of a dependency syndrome (if any) and improve smallholder commercialization outcomes.

2 DATA

The study purposively selected four districts (Harry Gwala, Umzinyathi, Umkhanyakude, and Uthukela) in the KwaZulu-Natal (KZN) province. One of the reasons that informed this choice is the importance of smallholder farming in these districts. Household income levels in these districts were relatively lower than other districts (Stats, 2012). KZN is among the poorest provinces in South Africa, with depressed rural economies (Godfrey et al., 2016). Social grants play an important role in the livelihoods of rural households in South Africa and in this province. The total number of social grant beneficiaries in South Africa as of February 2018 is 17 453 451 (SASSA, 2018). The total number of social grant beneficiaries in KZN alone as at February 2018 is 3 876 439 (SASSA, 2018). The total amount of money spent on social grants in South Africa is estimated to be R162 960 723 in 2018/19 (National Treasury, 2018).

The sampling was facilitated by the extension offices which provided the list of smallholder farmers which served as a sampling frame. Of the 984 households sampled, the analysis only included 774 farmers who had planted maize. A structured questionnaire was pretested and administered between June and November 2014 employing trained enumerators fluent in the local language, isiZulu. For details on the data collection process and which data variables were collected, see Sinyolo (2016).

3 THEORETICAL FRAMEWORK

The underlying theory for the empirical analysis is the random utility framework (McFadden, 1974), which is used for conceptualizing household market participation decision making allowing for imperfect markets (de Janvry, Fafchamps, & Sadoulet, 1991). The framework asserts that smallholder farmers’ decision to participate in maize markets depends on the anticipated utility outcomes. This decision, among other factors, is associated with the maize marketable surplus. Given that market conditions are imperfect, the market participation decision depends on transaction costs. De Janvry et al. (1991) argue that market failure is household-specific as households participating in the market realize net gains over the transaction costs, compared with their counterparts who realize negative benefits. The role of transaction costs to market access is well documented in the literature (Alene et al., 2008; de Janvry et al., 1991; Goetz, 1992; Key et al., 2000; Omamo, 1998). Furthermore, due to the market failures, the consumption and production choices of smallholder farmers in these areas are inseparable (Asfaw, Covarrubias, et al., 2012).

If the social grant income relaxes farm household credit and liquidity constraints, the outcome will be better chances to participate in the market. As these poor farm households are often excluded from credit markets, regular and reliable access to social grants can help them to overcome credit access barriers (Alderman & Yemtsov, 2013; Barrientos, 2012). If they are used in production, social grants can enhance the saving capacity of poor households; improve access to credit, provide increased security, and help compensate for insurance market failures, facilitating investment or market participation (Barrientos, 2012; Boone et al., 2013). Also, the regularity and predictability of social grants can encourage risk-taking among beneficiary households as it guarantees a minimum level of subsistence, even if market participation activities do not pay off (Boone et al., 2013). Market participation is risky and poor households lack buffers or insurance to protect their consumption or assets against market hazards (Barrientos, 2012).

The negative unintended outcomes are mainly due to the income effect of social grants, as this additional income leads to an increase in the consumption of goods and leisure. If it is strong enough, this has a negative effect on the propensity to work as the beneficiaries can still maintain their utility level through the unearned income (Barrett, 2006; Binger & Hoffman, 1998). Social grants, therefore, have the potential to entrench a dependency syndrome among beneficiary households (Abel, 2013; Devereux, 2013), thereby reducing households’ motivation to engage in income-generating activities. As such, access to social grants may enhance or deter small farmers’ market participation.

Two outcome variables were considered in the empirical analysis: (1) a dummy variable showing whether a household sold maize in the year preceding the survey and (2) a continuous variable showing the quantity of maize sold (in tons). The majority of social cash transfer impact studies, with the exception of a few (e.g., Agüero et al., 2007; Handa, Davis, Stampini, & Winters, 2010; Sinyolo et al., 2017bb; Tiwari et al., 2016) took access to social transfers as a dummy variable. However, this approach fails to account for the level of social transfer support (Agüero et al., 2007; Bia & Mattei, 2012). To capture social grants, the study mainly used the proportion of household income from social grants. As the social grants are given to individual household members and each household differs in terms of a number of social grant beneficiaries, there is a high degree of heterogeneity in the contribution of social grants to household income.

4 THE EMPIRICAL ESTIMATION METHODS

In this paper, the propensity score matching (PSM) and the generalized propensity score (GPS) methods were used to estimate the impact of social grants on the probability and levels of market participation. When access to social grants was captured as a binary variable, PSM (Rosenbaum & Rubin, 1983) was used, while GPS was used when the continuous specification of the treatment variable was considered, specifically, the proportion of household income from social grants. The use of the experimental or randomized designs is not applicable when studying social grants in South Africa because these grants were not implemented with an experimental design but are targeted to individual household members based on their socioeconomic status (e.g., age, income levels, health status, etc.; Patel, Hochfeld, & Moodley, 2013).

PSM methods are commonly used for the estimation of causal effects in a binary treatment framework. If the unconfoundedness assumption (conditional independence) holds, PSM approaches result in the reduction of biases in estimated treatment effects (Bia, Flores, Flores-Lagunes, & Mattei, 2014). The PSM matching procedure was implemented under the Stable Unit Treatment Value Assumption (SUTVA). This assumption requires that the potential outcomes for any unit do not vary with the treatments assigned to other units (no-interference assumption). Recent studies, such as Aronow and Samii (2017) and Arpino and Mattei (2016), have considered situations when SUTVA is violated due to interference among units, demonstrating that the causal effect is underestimated when interference is ignored. In this study, we did not consider the issue of networking among the households a potential source of interference among the units. While networking may affect market outcomes, it does not significantly affect access to social grants, as the South African social grants program typically works well in terms of identifying the target beneficiaries across various categories (van der Berg, Siebrits, & Lekezwa, 2010).

Moreover, the SUTVA requires that each unit must not have different forms or versions of each treatment level (Imbens & Rubin, 2015). Various versions of the propensity score-based methods have been developed to cater for treatments that are not binary, that is, allowing for treatment to be multivalued. For example, PSM has been extended to deal with treatment variables that are categorical (Imbens, 2000; Lechner, 2001), ordinal (Joffe & Rosenbaum, 1999; Lu, Zanutto, Hornik, & Rosenbaum, 2001) or continuous (Bia & Mattei, 2008, 2012; Bia et al., 2014; Flores, Flores-Lagunes, Gonzalez, & Neumann, 2012; Guardabascio & Ventura, 2014; Hirano & Imbens, 2004; Imai & Van Dyk, 2004; Kluve, Schneider, Uhlendorff, & Zhao, 2012). The GPS is an extension of the PSM that deals with continuous treatment.

(1)

(1)The fundamental problem of causal inference in the context of program evaluation is that of missing data, as the treatment indicator takes either the value of one or zero but not both (Holland, 1986; Rubin, 1976). The market outcomes for the beneficiaries, had they not been beneficiaries, cannot be observed. Similarly, the market outcomes of nonbeneficiaries, had they been beneficiaries, cannot be observed. The PSM, measuring the probability that a household is a beneficiary, generates the missing data. The study used the nearest K-neighbors (K = 5) and kernel (bandwidth = 0.06) matching techniques to estimate the impact. The treatment observations with weak common support were dropped.

We make the assumption of selection on observables (the conditional independence assumption; Heckman, Ichimura, & Todd, 1997). In cases where unobserved variables affect access to social grants and the market outcomes, then the matching estimators are not robust to hidden bias (Rosenbaum, 1991, 2002). The Rosenbaum bounds sensitivity test assessed the sensitivity of the estimated average effects to hidden bias (Rosenbaum, 2002). In this study, the focus was placed on positive self-selection in determining overestimation of ATT.

As already mentioned above, when focusing on the estimation of the proportion of household income from social grants, the GPS-based method has been implemented. The GPS is a balancing score, which is the conditional probability of receiving a particular dosage subject to a given set of observable variables (Hirano & Imbens, 2004; Imbens, 2000; Rosenbaum & Rubin, 1983). The treatment effects were estimated using two-step semiparametric estimators of the dose-response function (DRF), following Bia et al. (2014). The first step involved the estimation of the GPS (Ri) and assessing the common support condition and the balance of the covariates. This was followed by estimating the DRF using the nonparametric inverse-weighting kernel estimator proposed by Flores et al. (2012).

Given the continuous treatment variable, level of dependence on social grants, GDi, in this study is a fraction, a β distribution was used for estimating the score. The bounded nature of the treatment variable is such that the effect of any particular covariate is not constant over its range, implying that there is no guarantee the ordinary least squares regression estimates would lie in the unit interval even after augmenting the model with nonlinear functions of the covariates (Guardabascio & Ventura, 2014; Papke & Wooldridge, 1996).

(2)

(2) is a probability density function; h is a flexible function of covariates depending on an unknown parameter γ;

is a probability density function; h is a flexible function of covariates depending on an unknown parameter γ;  is a scale parameter and

is a scale parameter and  are the covariates. The common support or overlap region was determined following Flores et al. (2012) while the likelihood ratio test evaluated how well the estimated GPS balances the covariates. The introduction of several pretreatment covariates strengthened the plausibility of the unconfoundedness assumption.

are the covariates. The common support or overlap region was determined following Flores et al. (2012) while the likelihood ratio test evaluated how well the estimated GPS balances the covariates. The introduction of several pretreatment covariates strengthened the plausibility of the unconfoundedness assumption.The DRF and the treatment effect function were estimated using a nonparametric IW estimator. This involves weighting of observations using the estimated scores to adjust for covariate differences. The nonparametric method is flexible and does not impose a parametric structure on the data, which would have led to misleading results if not met (Bia et al., 2014). The estimates of the DRF and treatment effect function were observed at 10 different levels of social grant dependency, considering increments of 10% for the treatment effect estimation.

5 RESULTS AND DISCUSSIONS

Table 1 shows the pretreatment characteristics of the sampled households. About 57% of these households participated in the market and sold 42% of their maize output. This level of market participation is similar to findings in other studies from rural South Africa. Biénabe and Vermeulen (2011) reported 43% maize market participation in Limpopo Province. The majority (85%) of the households were beneficiaries of social grants and the grants contributed significantly to the incomes of these households. The table shows that the households were poor, characterized by low income and asset levels. Access to support services like an extension, information, credit, and markets were generally low.

| Variable name and description | Means/proportions | Standard deviations |

|---|---|---|

| Maize output harvested last season (tons) | 0.516 | 0.969 |

| Household sold maize in the market last season (1 = Yes, 0 = No) | 0.57 | 0.49 |

| Quantity of maize sold (tons) | 0.278 | 0.817 |

| Price of maize output per ton (Rands/ton) | 1,484 | 616 |

| Proportion of maize output sold | 0.45 | 0.43 |

| Household has access to social grants (1 = Yes, 0 = No) | 0.85 | 0.36 |

| Annual income from social grants (Rands) | 16,587 | 13,690 |

| Annual income from farm activities (Rands) | 6,553 | 12,437 |

| Annual income from other off-farm activities (Rands) | 40,204 | 27,880 |

| Proportion of income from social grants | 0.38 | 0.25 |

| Household head age (Years) | 56 | 13 |

| Household head gender (1 = Male, 0 = Female) | 0.47 | 0.50 |

| Household head education level (Years) | 4.67 | 4.17 |

| Household size (Numbers) | 7.04 | 3.59 |

| Land size household has access to (ha) | 1.93 | 4.47 |

| Livestock size (tropical livestock units [TLUs]) | 3.54 | 17.40 |

| Value of household assets (Rands) | 82,105 | 38,938 |

| Access to extension (1 = Yes, 0 = No) | 0.57 | 0.50 |

| Number of information sources | 2.28 | 1.10 |

| Market access (1 = Good, 0 = Poor) | 0.20 | 0.40 |

| Access to credit (1 = Yes, 0 = No) | 0.36 | 0.48 |

| Access to agricultural training (1 = Yes, 0 = No) | 0.41 | 0.49 |

| Farmer group member (1 = Yes, 0 = No) | 0.42 | 0.49 |

| Distance to the maize market (km) | 24 | 29 |

| Household head farming experience (Years) | 19 | 13 |

| Access to water for irrigation purposes (1 = Yes, 0 = No) | 0.46 | 0.50 |

| Household head off-farm employment (1 = Yes, 0 = No) | 0.20 | 0.40 |

| Ownership of small nonfarm business (1 = Yes, 0 = No) | 0.08 | 0.27 |

| District 1 (1 = Harry Gwala, 0 = Otherwise) | 0.42 | 0.49 |

| District 2 (1 = Umzinyathi, 0 = Otherwise) | 0.24 | 0.43 |

| District 3 (1 = Uthukela, 0 = Otherwise) | 0.19 | 0.40 |

| District 4 (1 = Umkhanyakude, 0 = Otherwise) | 0.15 | 0.35 |

Results on the impact of access to social grants on market participation are presented in Table 2.

| Matching method | Probability of market participation | Level of market participation | ||

|---|---|---|---|---|

| ATT | t Test | ATT | t Test | |

| Nearest five neighbors | −0.17 (0.07) | −2.42** | −0.219 (0.100) | −2.19** |

| Kernel matching (bandwidth = 0.06) | −0.21 (0.07) | −2.63*** | −0.258 (0.101) | −2.55*** |

- Notes. ** and *** mean significant at 5% and 1% significance levels, respectively. Bootstrapped standard errors (1,000 repetitions) are in parenthesis.

- ATT: average treatment effect on the treated; PSM: propensity score matching.

Social grant beneficiaries were less likely to participate in the market compared to their counterparts. The results demonstrate that social grant beneficiaries sold over 200 g less maize than nonbeneficiary households seasonally, suggesting a negative effect of social grants on market participation. This result suggests that, in countries where households running small farms receive social welfare payments, these payments can be disincentives to market participation including the intensity of participation, that is, it becomes less necessary to sell produce, as cash constraints are addressed by grants. As a result, the beneficiary households end up exerting less effort, farming less, producing a less marketable surplus, and consuming (selling less) most of what they produce.

According to the Rosenbaum (2002) bounds test, results were insignificant at Γ = 1.80 and 2.20 (Tables 3 and 4) for the probability and the level of market participation outcomes, respectively, implying that the results can be undermined if the hidden bias is over 80% and 120%. These large percentages suggest that the results are relatively robust to hidden bias. That is, the unobserved covariates, such as political connections, intelligence, or ability would have to increase the odds of a farmer applying and receiving a grant compared to an identical farmer by more than 1.8 times to interfere with the results. This is not expected, given the efforts the South Africa Social Security Agency (SASSA) makes to reach out to all qualifying individuals (DSD et al., 2012).

| Wilcoxon statistics | ||

|---|---|---|

| Γ | Upper bound significance level | Lower bound significance level |

| 1 | 0.000 | 0.001 |

| 1.1 | 0.000 | 0.000 |

| 1.2 | 0.001 | 0.000 |

| 1.3 | 0.026 | 0.000 |

| 1.4 | 0.069 | 0.000 |

| 1.5 | 0.016 | 0.000 |

| 1.6 | 0.031 | 0.000 |

| 1.7 | 0.055 | 0.000 |

| 1.8 | 0.089 | 0.000 |

| 1.9 | 0.135 | 0.000 |

| 2.0 | 0.191 | 0.000 |

| 2.1 | 0.255 | 0.000 |

- Note. Bold refers to values at the Rosenbaum critical gamma cutoff value.

| Wilcoxon statistics | ||

|---|---|---|

| Γ | Upper bound significance level | Lower bound significance level |

| 1 | 0.000 | 0.001 |

| 1.1 | 0.000 | 0.000 |

| 1.2 | 0.000 | 0.000 |

| 1.3 | 0.000 | 0.000 |

| 1.4 | 0.000 | 0.000 |

| 1.5 | 0.000 | 0.000 |

| 1.6 | 0.000 | 0.000 |

| 1.7 | 0.000 | 0.000 |

| 1.8 | 0.000 | 0.000 |

| 1.9 | 0.002 | 0.000 |

| 2.0 | 0.009 | 0.000 |

| 2.1 | 0.031 | 0.000 |

| 2.2 | 0.083 | 0.000 |

| 2.3 | 0.174 | 0.000 |

| 2.4 | 0.306 | 0.000 |

| 2.5 | 0.462 | 0.000 |

- Note. Bold refers to values at the Rosenbaum critical gamma cutoff value.

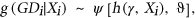

Assessment of the impact of dependence on social grants on market participation used the GPS approach. Figure 1 shows the average dose-response and treatment functions. The tests for the common support condition and the balancing property showed satisfaction of these assumptions.

The average dose-response and treatment functions and 95% confidence bands for the probability of market participation

The treatment effect function reveals how a 10% increase in the household level of dependence on social grants affects household market participation. The confidence bands are narrow in the range of treatment values greater than zero up to 80%, suggesting that the results are reliable in the same range. The wide 95% confidence bands suggest a high level of uncertainty of the average dose-response function (Bia & Mattei, 2012) above 80%, as a result of a small number of dependence levels beyond that point. As such, the shape of the graph indicating dosages greater than 80% is less robust/reliable and was not interpreted in this study. The semiparametric estimators are sensitive to small sizes and do not perform well in regions with few observations (Bia et al., 2014). Figure 1 indicates a negative relationship emerged between the probability of market participation and the dependence on social grants at treatment levels less than 30%. However, at treatment levels greater than 30% and less than 80%, the figure shows that variations in the level of dependence on social grants did not influence market participation.

The figure suggests that an increasing income from social grants reduces the probability of participation to farmers where grants contribute a limited amount to household income. These are less poor households with other sources of income so that additional income from social grants decreases chances of commercializing their farming activities. At higher grant dependency, households are poorer with limited alternative sources giving them no incentive to reduce possible economic activities that can augment their inadequate income.

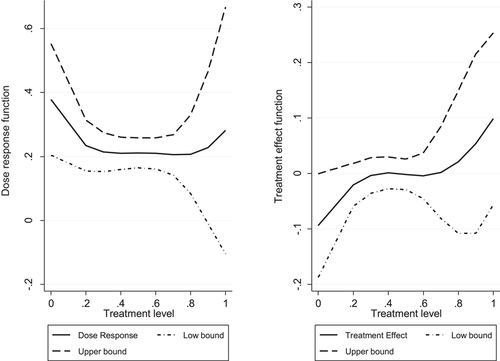

Figure 2 shows GPS results of the impact that social grants dependence has on the level of market participation. The higher the social grants income the less the maize sold. The narrow confidence bands suggest reliable results. One can deduce that increased social grants dependence reduces market participation.

The average dose-response and treatment functions and 95% confidence bands for the level of market participation

Overall, the matching results suggest that access to social grants rather increase grant dependency and decrease the probability and level of market participation. The latter would not have been the case if social grants eased the burden of transaction costs involved in accessing markets. Various authors suggest that social grants could positively impact the productive capacity of poor rural households (e.g., Boone et al., 2013; Covarrubias et al., 2012; Todd et al., 2010). They have counter effects on the household propensity to commercialize. Households benefiting from social grants have a higher tendency to be subsistence producers as they depend on the social transfers for income. Radel et al. (2016) and Todd et al. (2010) observed similar results in Mexico. In South Africa, Mabugu, Chitiga, Fofana, Abidoye, and Mbanda (2014) and Sinyolo, Mudhara, and Wale (2017a) identified disincentive effect of social grants on smallholders’ production and marketing incentives.

6 CONCLUSIONS

This study used the matching methods to investigate what impact social grants have on the incentives of smallholder maize producers to commercialize their farming activities. The study results suggest that social grants undermine smallholder incentives to produce a marketable surplus or sell their agricultural produce. Social grants dependence was found to result in decreased probability and level of maize market participation. The findings suggest that social grants are spilling over to undeserving household members, reducing incentives to engage in income-generating economic activities at the household level. This issue will remain an inherent challenge as household resources are shared among members not only in South Africa but in Africa at large. The implementation of social welfare programs in South Africa has been found to have negative unintended consequences on smallholder commercialization. While these findings do not justify the removal of social grants, they highlight the need to synchronize social grants and smallholder commercialization interventions.