Reforming Agricultural Support for Improved Environmental Outcomes

Abstract

Agricultural support has changed substantially in both rich and poor countries in recent years. In rich countries, there has been a strong move to decoupled subsidies and a fall in average rates of protection. In developing countries, market price support remains the dominant form of protection, and average rates of support have risen—breaking the traditional pattern of taxing agriculture. Emissions from agriculture and land use change have contributed up to a third of total greenhouse gas emissions, with beef, milk and rice production accounting for more than 80% of agricultural emissions. Agricultural support was biased against emission-intensive goods until recent years and is now only slightly biased toward them. Although emission intensities are relatively higher in the developing countries, they have fallen far more rapidly in developing countries than in the rich countries in the past quarter century, as agricultural productivity has grown in developing countries. Policy reform will be challenging given the strong political-economy support for the current structure of protection. Increasing investments in research and development to raise productivity and lower the emissions intensity of agricultural output would help agriculture and the environment.

JEL CLASSIFICATION

F18; F64; Q18; H23; Q58

The fifty-one developed and developing countries covered by the OECD's, 2018 agricultural policy monitoring and evaluation provided $483 billion per year in 2015–17 in support to farmers (OECD, 2018, p105); $86 billion on services such as agricultural innovation, infrastructure and stockholding; and $50 billion in transfers from taxpayers to consumers. Most of the $483 billion in support to farmers is provided in the form of trade measures that raise (or lower) prices received by farmers relative to world prices, with $69 billion of this provided in the form of direct subsidies. Although agriculture has many environmental impacts, we focus on emissions of greenhouse gases (GHG) because of their global impact and their potentially catastrophic consequences for the world, and for agriculture in particular. With agricultural production and land use change contributing close to a quarter of global GHG emissions, this spending has potentially large implications for greenhouse gas emissions and hence for climate change. However, the magnitude and even the direction of these policy impacts is uncertain, making analysis essential for well-founded policy recommendations.

These incentives affect environmental outcomes by changing (i) how much is produced, (ii) what is produced, (iii) where it is produced, and (iv) how goods are produced. To assess the environmental impact of agricultural subsidies, we need to account for the output-related effects ((i), (ii) and (iii)) and the technology effects (iv). Support that is coupled with output of emission-intensive goods generally increases output in the region providing support and the associated emissions. Use of coupled subsidies will be particularly damaging for global emissions if the emission intensity (emissions per unit of output) is higher in the region providing support than in other regions, or if it encourages the use of emission-intensive practices or technologies. Similarly, subsidies coupled with specific inputs will encourage greater use of those inputs and may generate increased emissions, particularly if the input is emission intensive. Decoupled subsidies, by contrast, are expected to transfer income directly to recipients without altering market incentives, potentially reducing economic and environmental costs and providing greater net benefits to producers per dollar of support because they do not require costly increases in output.

Support to farmers may also have favorable impacts on environmental outcomes. If, for instance, support is provided primarily for products that are relatively less emission intensive, it may take resources away from emission-intensive activities. If support is provided subject to conditions designed to improve environmental outcomes, it may also help to reduce emissions. Support may also be designed to create incentives for producers to use climate-smart production approaches that both reduce costs and contribute to better environmental outcomes (Engel & Muller, 2015) or to help the agricultural sector to adapt to climate change (Glauber, 2018).

Reform should not focus solely on achieving the “right” set of agricultural support measures. Policy makers are pursuing multiple goals when promoting agricultural development—including achieving food security, improving incomes for farmers, and rectifying market failures such as environmental externalities and under-investment in agricultural R&D that results from the limited ability of private investors to capture the benefits of investments in improving agricultural crops. To achieve multiple targets, a basic rule of thumb states that policy makers must have at least as many policy instruments as they have goals (Tinbergen, 1956). There are potentially complementarities between instruments, as when an improved agricultural technology allows reductions in emissions, increases in productivity, improvements in food security, and increases in the resilience of production. However, there are also potential tradeoffs where, for example, improvements in productivity require more inputs of nitrogen fertilizer that increase emissions, or reductions in emissions come at the cost of lost productivity and reduced food security.

Fortunately, policy makers have many policy instruments including different types of agricultural subsidies and measures affecting emissions and nutritional outcomes more directly. Widely used measures with important impacts on agriculture include: (i) provision of public goods such as rural infrastructure, agricultural research and development, and water rights; (ii) consumer taxes or subsidies that influence the demand for agricultural products without being directly identified as producer subsidies or taxes; (iii) policies affecting demand and supply in downstream value chains of agricultural commodities (e.g., biofuel policies1). Considering the full range of relevant policies is important not just for achieving the goals of any individual policy maker but also for helping reach agreement on policy reforms, especially where different stakeholders have sharply different interests and/or preferences.

Many critiques of current agricultural support—and agricultural policies more generally—have pointed to contradictions at the heart of current policies. Most support is provided in the form of higher prices or direct subsidies that create deadweight economic losses, provide most of their benefits to larger producers, and are capitalized into land values (Goodwin et al., 2012), although policymakers frequently under-invest in public goods such as research and development, innovation, and infrastructure. Support varies widely by commodity and is frequently lavished on foods that are particularly large sources of greenhouse gases. Towering subsidies in rich countries deny poor farmers in developing countries the opportunity to compete. Many people remain unable to access enough food because they are too poor to be able to buy food.

In the next section of the paper, we consider the range of policy instruments used to influence agricultural outcomes and the extent to which they change farmers' incentives to produce. In the third section we focus on the greenhouse gas emissions associated with agriculture and land use change. Then, in the fourth section, we consider the potential impacts of subsidies and related measures on emissions. The fifth section examines policy conditionality and targeting. With this as backdrop, the sixth section considers potential paths to reform, given political-economy constraints on reform. Conclusions are presented in section VII.

AGRICULTURAL SUPPORT AND RELATED MEASURES

Support to and taxation of agriculture comes in many forms, but it is useful to distinguish three main forms of support2: (i) market price support, (ii) coupled subsidies, and (iii) decoupled subsidies. Governments generate market price support by introducing barriers to trade such as tariffs, licenses, and quotas that raise (or lower) the domestic price relative to world prices. Coupled subsidies include measures such as subsidies to output or to inputs that increase the returns to producers and hence their incentives to produce specific goods. Decoupled subsidies base payments on something fixed, such as production in an historical period, and remove the link between support and output levels. In addition to the support provided in the form of subsidies, governments also intervene to improve the enabling environment for agriculture, providing goods that would otherwise be under-provided, such as research and development and rural infrastructure. Governments also intervene in many ways that indirectly affect agriculture but outside the scope of support as conventionally defined, such as by imposing mandates for use of biofuels and improving access of poor people to food through social safety net programs.

These forms of support differ in two important ways: whether governments need to fund them directly, and how they influence production. Market price support is generally found in importing countries, where the fact that tariffs raise revenue makes it attractive to policy makers and reduces the need for (frequently rigorous) review by Ministries of Finance. Subsidies, by contrast, need to be funded from scarce government resources and so tend to undergo regular scrutiny. Market price support distorts both consumption and production decisions, whereas coupled subsidies directly distort only production.

Historically, developed countries have tended to support agriculture, frequently using trade barriers to limit imports. Developing countries have also imposed export taxes aiming to lower domestic prices and, hence, lowering food costs to consumers, while reducing returns to producers. Some developing countries have also taxed the agricultural sector to generate government revenue, especially by taxing exports of cash crops during commodity-price booms. Developed countries, in contrast, put more emphasis on coupled subsidies in addition to market price support. A number of developing countries also use coupled subsidies, sometimes to offset the adverse impacts of export taxes on farmer incentives. As shown by Anderson (1995), there were strong political-economy reasons for poor countries to tax agriculture and for rich countries to support it. Historically, few countries have provided decoupled subsidies, even though those provide more direct income support to producers and hence are easier to target.

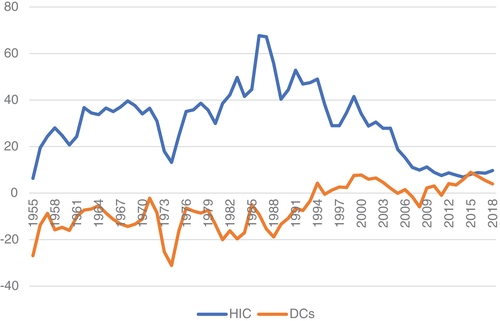

Figure 1 presents the average nominal rate of protection (NRP) for agriculture for high-income and developing countries, underlining the above discussion. The NRP reflects the support provided by border measures such as tariffs and quotas, or taxation imposed through measures such as export taxes or quotas. NRPs in high-income countries rose until the late 1980s and have since declined. NRPs in developing countries were negative until the early 1990s but have since become modestly positive on average.

Sources: For period 1955–2004, Anderson (2009); for period 2005–2018, Ag Incentives Consortium, www.ag-incentives.org

[Color figure can be viewed at wileyonlinelibrary.com]As protection to agriculture in the industrial countries rose in the 1970s and 1980s (Figure 1), it created increasing conflict between countries, with exporters dismayed by the low prices that ensued when other exporters paid substantial export subsidies—and the subsidizers realizing that their expensive subsidies were depressing world prices rather than achieving their desired goal of raising producer prices (Johnson, 1991). Reforming these policies was challenging and required a sustained push from policy reformers, accompanied by policy analysis identifying options for reform and analyzing their consequences. During the Uruguay Round, WTO members identified approaches that would allow them to begin the process of reducing support provided through border measures (Martin & Winters, 1996).

Although the restrictions on industrial country support to agriculture under the Uruguay Round were weaker than they seemed (Hathaway & Ingco, 1995), they appear to have had an enormous impact on applied rates of agricultural protection. After rising continuously between the 1950s and the late 1980s—except for a sharp decline during the 1973–4 commodity boom—border support in the industrial countries fell sharply from the early 1990s. In the developing countries, the limits on agricultural support were much weaker relative to prior levels of support, and the sharp upturn in economic growth rates of developing countries beginning in the early 1990s contributed to an increase in border protection from the consistently negative rates prior to the 1990s to, on average, slightly positive assistance since that time (Martin, 2018).

Although there are many ways to disaggregate protection data geographically, we focus primarily on the distinction between the on-average richer OECD countries and non-OECD countries. We do this to investigate the differences in the overall emission intensity and emission levels between these groups of countries. We also consider this split because of the sharp differences in patterns of support between these two groups.

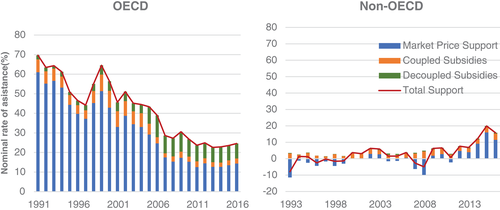

The WTO limits on market price support are commodity specific, whereas those on domestic subsidies include flexibility to average across many commodities. Decoupled subsidies are, by design, essentially unconstrained by WTO rules. These rules might be expected to result in a shift in support away from market price support. To see whether this has been the case, we compare the evolution of these three different forms of support in Figure 2. For this analysis, we turn to the OECD database that covers 85%3 of global agricultural production (12 non-OECD and almost all OECD economies) and allows us to disaggregate protection measures in the way that we need, although its coverage of smaller developing countries is less than in the broader “Ag Incentives” database4 underlying Figure 1.

Note: Support is expressed as a % of value of production at undistorted prices (i.e. prices net of the country's own tariffs and subsidies). Source: OECD (2018) for all countries for 1991 to 2016, and Anderson (2009) for India for 1991 to 1999

[Color figure can be viewed at wileyonlinelibrary.com]As shown in Figure 2, a key change in OECD country protection since 1990 has been a sharp decline in the rate of assistance provided through market price support, associated with an increase in decoupled subsidies. Market price support in the OECD countries fell from over 60% in 1991 to 13% in 2016, computed as market price support in share of agricultural sectors' value of production. By contrast, decoupled support rose from only 2% in 1991 to a peak of 11% in 2006, declining to 8% in 2016, as a share of agricultural production value. Distorting coupled subsidies such as output and input subsidies declined from almost 7% of agricultural production value in 1991 to 2.6% in 2016. However, market price support has risen slightly in recent years, suggesting a continuing tendency for support to rise when world prices fall.

In non-OECD countries, total support was much more volatile, being negative in the early 1990s and around the 2007–2008 price spike, and oscillating around zero in most years up to 2013. However, between 2014 and 2016, it increased dramatically, peaking at 19.9% of the value of production at undistorted prices in 2015. Most of the support in non-OECD countries is in the market price support category and decoupled subsidies remain very small. Coupled subsidies, such as those on output and on inputs such as fertilizer and water, accounted for about a quarter of total support in 2016.

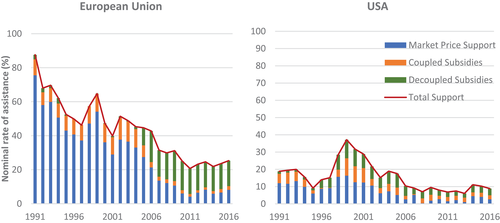

To understand developments in OECD countries' support to agriculture, it is important to look at the two largest players, the European Union (EU28) and the United States, as shown in Figure 3. In the European Union, support was almost exclusively provided by market price support in 1990, with only 2.7 percentage points of the 87.6% nominal rate of assistance consisting of decoupled payments. From the early 2000s, however, decoupled subsidies began to replace coupled subsidies, with both market price support and coupled subsidies dropping dramatically as a share of the value of output, whereas decoupled subsidies rose sharply in importance. By 2016, decoupled subsidies accounted for 15% out of 25% in total support. In the United States, both the share and the level of market price support fell sharply over the period. Both coupled and decoupled subsidies rose dramatically during the period of depressed world prices between 1996 and 1998. By 2016, total support, at 9%, was less than half the level in 1991, and decoupled support made up close to half of that support (Figure 3).

Note: All measures as defined in Figure 2

[Color figure can be viewed at wileyonlinelibrary.com]

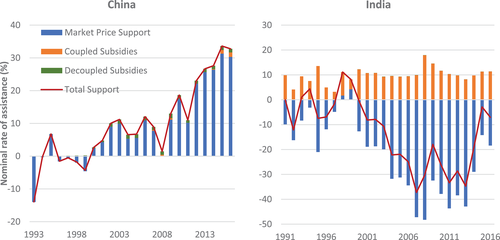

Source: OECD (2018) for China for 1993 to 2016, OECD (2018) for India for 2000 to 2016, and Anderson (2009) for India 1991 to 1999

[Color figure can be viewed at wileyonlinelibrary.com]Given the size of China and India as agricultural producers, changes in average agricultural support to non-OECD countries tend to be driven by changes in their support, as depicted in Figure 4. In China, the picture is very clear, with nominal rates of assistance trending up from about 2000 from the negative levels that had prevailed in the 1980s and 1990s to over 30% by 2015. Although China provided some coupled subsidies and decoupled subsidies, these were very small throughout the period relative to market price support. Roughly half of the market price support was provided to maize, pork, rice, and wheat in 2015 (OECD, 2018). Since then, market price support to maize has fallen with the abolition of the administered price for maize (WTO, 2019).

In India, market price support has been negative and substantial throughout most of the period, although the rate of taxation on agriculture declined sharply in the last two years of the sample. Because domestic prices are insulated from world market prices, the market price support/taxation for individual commodities varies sharply from year to year, but the commodities with the largest negative transfers—accounting for more than half the total negative MPS—on average between 2005 and 2016 were milk, rice, wheat, bananas, and mangoes. Coupled subsidies, mostly in the form of input subsidies, have been positive throughout the period but substantially below the rate of agricultural taxation leaving total assistance strongly negative in most years.

The impact of agricultural support on environmental externalities is influenced both by the extent to which they increase agricultural output and the extent to which they change the mix of products produced. Because the responsiveness of overall food demand and supply to prices is low, total agricultural output is not likely to be greatly changed by agricultural support. However, switching land between agricultural activities is often relatively easy so the price responsiveness of individual commodities is frequently larger than for agriculture as a whole.

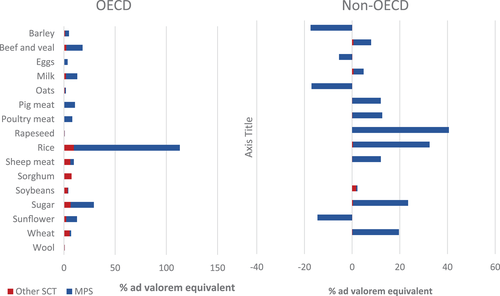

If support is substantial and linked to output of emission-intensive commodities such as rice and livestock products, then support will increase emissions from these products. The average support rate to individual commodities is shown in Figure 5 for both OECD and non-OECD emerging economies. This measure includes only measures that support individual commodities, either through market price support or output/input subsidies and therefore almost entirely excludes decoupled transfers. Within the OECD, the highest rate of assistance is provided to the production of rice, followed by that of sugar and livestock products. For the non-OECD countries, rice, wheat, sugar, and milk all have relatively high rates of support. Within both groups of countries, there is considerable variation across commodities.

Note: Other SCT refers to Single Commodity Transfers other than those provided by market price support. All percentages are relative to the “undistorted” value of production. Source: OECD (2018) for all countries for 1991 to 2016, and Anderson (2009) for India 1991 to 1999

[Color figure can be viewed at wileyonlinelibrary.com]Both OECD and non-OECD countries provide public goods such as agricultural research and innovation investments and rural infrastructure. The benefit–cost ratios for these interventions have been found to be generally substantially greater than one (Alston, 2018; Fan et al., 2018; Mogues et al., 2012), with the highest rates of return to investments in research and development. By contrast, the benefit–cost ratio for subsidies is almost by definition less than one because of the deadweight costs associated with inducing high-cost production and distorting consumer choices (through changing domestic prices). In both country groups, public-good investments are small relative to total support. In the OECD countries, they average around 12% of total support (OECD, 2018), with the largest allocations going to infrastructure and research and knowledge generation. In the non-OECD countries, this type of support averaged around 16% of total support, with the largest amount spent on public stockholding and most of the remainder on infrastructure and knowledge generation.

One important study in this context is Henderson and Lankoski (2020; see this issue) that analyzed the relationship between agricultural support policies (using OECD PSE database) and a set of environmental impacts. This analysis was conducted in a range of country settings, using a farm-level and a market-level model. Based on the methods and environmental indicators used, market price support and payments based on unconstrained variable input use were the most environmentally harmful among the various PSE measures. Decoupled subsidies based on non-current crop area were the least harmful. The impacts of support policies that clearly change the competitiveness of one production activity in relation to another, such as payments based on current crop area or on current animal numbers, were more equivocal.

EMISSIONS FROM AGRICULTURE AND LAND USE

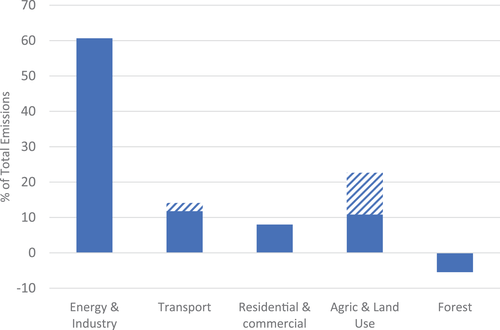

When considering mitigation priorities, a key question is the importance of each emission source, simply because any given percentage reduction in emissions has a larger impact, the larger the underlying flow of emissions. Figure 6 compares emissions from agriculture and land-use change with those from non-agricultural sources such as energy and industry, transport, and residential/commercial uses. This figure makes clear that agriculture and land-use change are major sources of global GHG emissions. With almost a quarter of global net emissions, they clearly need to be addressed if comprehensive reductions in emissions are to be achieved. Another striking feature of the graph is the small contribution made to emissions from international transport, including bunkers for shipping and aviation fuel, relative to other sources of emissions.

Source: FAOSTAT (accessed 14 March 2019). Note: The striped section of the Transport bar refers to international transport, whereas the striped section of the Agric & Land Use bar refers to land use, excluding carbon sequestration by forests, which is shown in the last bar

[Color figure can be viewed at wileyonlinelibrary.com]In the next subsection of this paper, we focus on the existing flow of emissions from agriculture, whereas in the following one we consider emissions from land use and land-use change.

Emissions from agricultural production

Because most distortions to agricultural incentives are commodity specific, emissions per unit of commodity output are needed to understand the direct impact of agricultural distortions on emissions. Fortunately, Tubiello et al. (2012) and Tubiello et al. (2013) developed such a set of measures and estimates based on this methodology are freely downloadable from FAOSTAT (Tubiello, 2019). These estimates are based on the IPCC Tier 1 Methodology that uses relatively stylized estimates of emissions per unit of output by region (IPCC, 2006), but these estimates are still sophisticated enough to differentiate between regions based on key agro-ecological features.5 Although the original database, as documented in Tubiello et al. (2013), included only rice and livestock products, the current version also includes non-rice cereals. Tubiello et al. (2013) note that these GHG emission estimates cover over 80 to 85% percent of total agricultural sector emissions, of which the majority comes from livestock (Tubiello et al., 2012). Average emission intensity and estimates of agricultural emissions by commodity as a share of total emissions for included sectors are presented in Table 1.

| OECD | Non-OECD | World | ||||

|---|---|---|---|---|---|---|

| Intensity | Share (%) | Intensity | Share (%) | Intensity | Share (%) | |

| Rice | 1.1 | 3.4 | 0.9 | 18.8 | 0.9 | 15.5 |

| Other cereals | 0.2 | 18.7 | 0.2 | 7.4 | 0.2 | 9.8 |

| Milk | 0.5 | 18.8 | 1.3 | 17.8 | 1.0 | 18.0 |

| Ruminant meat | 16.0 | 49.2 | 32.4 | 50.5 | 26.6 | 50.2 |

| Pig meat | 1.7 | 7.3 | 1.4 | 3.2 | 1.5 | 4.0 |

| Poultry meat | 0.3 | 1.4 | 0.7 | 1.3 | 0.6 | 1.3 |

| Eggs | 0.5 | 1.1 | 0.8 | 1.1 | 0.7 | 1.1 |

| Total (from incl sectors) | 100 | 100 | 100 | |||

- Note: 1. Intensity is measured in kg of CO2 equivalent per kg of output.

- Source: Authors' calculation based on FAOSTAT (accessed 3 March 2019) data on emissions and output.

A striking feature of Table 1 is the large share of ruminant meat (cattle, buffalo, goats and sheep) in total emissions, both in the OECD and in the rest of the world. Another striking feature is the enormous difference in the importance of rice between the OECD and the non-OECD countries. Milk production emissions accounts for around 18% in both regions. Pig meat and poultry products account for only 6% of total emissions globally and less than 10% even in the OECD countries. Close to 70% of emissions are associated with production of ruminant meat and milk largely because emissions resulting from enteric fermentation in the ruminant digestive process and emissions associated with manure are important contributors to global emissions from agriculture (see Tubiello et al., 2013, 6). The shares of emissions from the non-OECD group across commodities are much closer to the world average shares because non-OECD emissions from agriculture are 3.6 times as large as those from the OECD group.

The substantial support to milk production in both OECD and non-OECD countries is seen in Figure 5. This and the even more significant support to beef production in the OECD countries clearly have important implications for producer incentives. The fact that most of this support is provided through market price support is something of a mixed blessing. Market price support is clearly worse than coupled subsidies when the focus is on trade impacts because market price support in protecting countries increases production in these countries and lowers global prices. However, when the focus is on global emissions, the feature that is adverse for trade (i.e., the larger reduction in prices outside the group of protecting countries) has a favorable impact. Countries not providing protection through market price support—or providing less than the average amount of support—face lower external market prices and reduced incentives for production than if the same amount of producer support were provided by coupled subsidies in the protecting country. This distinction is fundamental and does not appear to have been considered in other studies. In fact, it reverses the widely used ranking of MPS and coupled subsidies under which MPS is considered more perverse than coupled subsidies (Mayrand et al., 2003, 41). Although capturing the quantitative effect of this distinction requires a formal model, it is important to recognize it in a broad study of this type.

To the extent that market price support in OECD countries stimulates output in those countries while depressing output in other countries, it is important to examine differences in the emission intensity of production in each region. Table 1 reveals some striking differences in emission intensities between commodities, with emissions per kg of output twice as high for ruminant meat and more than twice as high for milk in non-OECD countries relative to the OECD. By contrast, emissions per unit of output were substantially lower in the non-OECD countries for rice and for pig meat. When border protection in OECD countries increases output of beef and other meat in these countries but reduces it in the rest of the world, there is an adverse output effect on emissions in the rich countries but a favorable substitution effect as production shifts to low-emission, high-income countries and away from high-emission developing countries.

Another important question about emissions is where they are generated. Are they primarily generated in the rich countries, with diets heavy in livestock products? Or in developing countries, which accounted for nearly 90% of the value of agricultural production in 2015? As shown in Table 2, it turns out that this dietary composition effect is outweighed by the much greater production volumes in developing countries, and the higher emission intensities discussed above. The OECD share of emissions is highest for pigmeat and cereals other than rice and, at the other extreme, less than 5% for rice.

| OECD | Non-OECD | |

|---|---|---|

| Rice | 4.8 | 95.2 |

| Other cereals | 41.4 | 58.6 |

| Milk | 22.9 | 77.1 |

| Ruminant meat | 21.4 | 78.6 |

| Pig meat | 39.1 | 60.9 |

| Poultry meat | 23.3 | 76.7 |

| Eggs | 22.2 | 77.8 |

| Total | 21.8 | 78.2 |

- Source: FAOSTAT (accessed 3 March 2019).

The sharp differences in emission intensities between OECD and non-OECD countries raise an important question about the future path of emissions. What would happen to total emissions from developing countries if, with rising per capita incomes, they followed the path of the industrial countries by changing consumption and production patterns toward higher shares of milk and ruminant meats, without changing their emission intensities? One simple way to assess this is to calculate the total emissions that would arise from producing the current OECD output mix with the current non-OECD emission intensities. This indicates that emissions would be 78% higher than current OECD emissions.6 This is a troubling result, given the likely path of global food demand and supply with consumption of animal products increasing sharply as global food demand becomes more driven by per capita income growth than by population growth, as was the case in the past (Fukase & Martin, 2017). It should be noted that the trade patterns, that is, import of dairy and meat products by developing countries with high emission intensities for these products from developed countries with low emission intensities for these products, would complicate the answer to this question.

One important thing to keep in mind, however, is that the greenhouse gas emission intensities of production tend to decline strongly in response to agricultural productivity growth (Gerber et al., 2011). Because agricultural productivity growth is an important driver of overall economic growth and poverty reduction, and appears to have been more rapid in developing than developed countries in recent years (Martin, 2018), productivity growth may be an important offsetting factor to an otherwise inexorable increase in agricultural emissions. Because the emissions coefficients in the FAOSTAT emissions database reflect the impact of productivity growth on emissions intensities, it is possible to examine the changes in emission intensity of production in OECD and non-OECD countries since the early 1990s.

Table 3 presents estimates of the annual reductions in the emissions intensity of production between 1991 and 2015. Emission intensities are declining across the board for all countries. Furthermore, for all products, except milk, these declines in emission intensities are more rapid in non-OECD countries than in OECD countries. Although the annual reductions in emissions may look relatively small, over time, their cumulative effect are bound to be substantial.

| OECD | Non-OECD | World | |

|---|---|---|---|

| Rice | −0.5 | −0.8 | −0.8 |

| Other cereals | −0.4 | −0.6 | −0.5 |

| Milk | −1.7 | −1.3 | −1.1 |

| Ruminant meat | −0.5 | −1.1 | −0.6 |

| Pig meat | −1.0 | −2.0 | −1.6 |

| Poultry meat | −1.0 | −1.9 | −1.2 |

| Eggs | −0.4 | −0.7 | −0.4 |

- Source: Authors' calculations based on FAOSTAT emissions data.

The results presented in Table 3 highlight a potentially important role of investments in research and development in reducing emissions from agriculture. Past reductions in emission intensities reflect primarily producers' attempts—aided by innovations developed by public and private research expenditures—to lower their production costs and raise their incomes. The reduction in emission intensities would accelerate if additional investments in R&D were focused on reducing costs, increasing productivity, and reducing emission intensities. If, for instance, additional R&D were to focus on the problem of emissions due to enteric fermentation, which accounted for 44% of total agricultural emissions in 2010 (Tubiello et al., 2012), then it seems likely that more rapid progress might be made in dealing with this challenge. Boadi et al. (2004) point to a range of potential approaches for reducing these emissions. Given the inherent inefficiency of methane emissions from digestive processes, it seems likely that many approaches to dealing with this problem would be climate smart by reducing input and resource use as well as emissions per unit of output.

Emissions from land use change

Emissions from land use are heavily influenced by changes in stocks of carbon rather than ongoing flows such as those emanating from enteric fermentation or other emissions associated with agricultural production. This dependence on stock changes is most clear in the case of deforestation, where sequestered carbon is converted rapidly into CO2 as trees are burned in the land-clearing process. Carbon sequestration as forests grow also involves a stock adjustment process, with carbon dioxide being converted into sugars by photosynthesis and then into wood and other carbon sinks, as well as soil carbon sequestration where CO2 in the atmosphere is stored in soil.

Key numbers on emissions from land use and land use change are presented in Table 4. These numbers show emissions from forest land, cropland, grassland, and burning of biomass. For forests, the data can be divided into the sequestration of carbon resulting from forest growth and the release of carbon through deforestation resulting from conversion of forests into cropland. The numbers show the overwhelming importance of deforestation in determining net emissions from land use and land use change. In the OECD countries, where net deforestation is small or negative, the absorption of carbon into carbon sinks created by forest growth exceeds the emission of CO2 equivalents due to deforestation and generates negative net emissions. For non-OECD countries, the emissions due to deforestation exceed the absorption of CO2 from forest growth. The next most important influence on emissions from land use change is burning of biomass. This highlights the importance of moving away from cultivation practices that involve burning crop residues toward approaches such as zero till that allow for incorporation of residues into the soil, creating a potentially important sink for CO2.

| Forest land | Cropland | Grassland | Burning Biomass | Total | |||

|---|---|---|---|---|---|---|---|

| Forest land | Conversion | Total (Forest land) | |||||

| OECD | −959 | 125 | −834 | 116 | 13 | 254 | −451 |

| Non-OECD | −884 | 2,759 | 1875 | 551 | 33 | 1,651 | 4,110 |

| World | −1843 | 2,883 | 1,040 | 667 | 46 | 1905 | 3,659 |

| Africa | −227 | 1,032 | 805 | 53 | 12 | 728 | 1,599 |

| Asia | 53 | 592 | 646 | 394 | 17 | 661 | 1718 |

| Europe | −871 | 63 | −808 | 125 | 5 | 84 | −594 |

| North America | −246 | 60 | −186 | 53 | 7 | 246 | 120 |

| Oceania | −94 | 4 | −90 | 32 | 2 | 82 | 25 |

| South America | −393 | 1,079 | 685 | 9 | 3 | 96 | 793 |

| Southeast Asia | 331 | 529 | 859 | 356 | 14 | 647 | 1877 |

- Source: FAOSTAT (accessed 3 March 2019). Note: Values are in millions of tonnes of CO2 equivalent.

Land use and land-use change patterns not only differ starkly between OECD and non-OECD countries but also by geographic region, as can be seen in Table 4. In North America, Europe, and Oceania, forests form a net CO2 sink. In Europe, CO2 withdrawals by forests more than offset emissions from all other land use and land-use changes. In contrast, forest conversion is a significant source of GHG emissions in Africa, South America, and Southeast Asia. Emissions from burning biomass are particularly large in Africa and Southeast Asia.

As noted by Byerlee (2020), deforestation in developing countries was, until the late 20th century, largely for domestic production of staple foods. However, rapid income growth in developing countries has contributed to growth in demand for livestock products that, in turn, has sharply increased demand for livestock feed inputs, such as soybeans. Deforestation in tropical areas is also associated with expanding land use for export production of palm oil and soybeans. Some of this production is for biofuels, and policy makers have begun to express concerns about the potential impact of these policies for deforestation. As emphasized by Byerlee (2020), dealing with the deforestation problem is likely to require a multistrand approach, including sustainable intensification to reduce the footprint of agriculture, improvements in land tenure to reduce the incentives for deforestation created by market failures.

IMPLICATIONS OF AGRICULTURAL SUPPORT FOR EMISSIONS

Agricultural production receiving support should be expected to increase relative to the output of other commodities. Because agriculture's share of GHG emissions is much larger than its share of global GDP, one may also expect this to lead to an increase in global emissions. However, this effect is generally thought to become more muted over time as the scope for further land expansion is limited by arable land constraints and by far most of future production increase would have to come from increased resource efficiency (FAO, 2017). Further, higher production coming from land expansion would decrease prices and mitigate the impact partially. Nonetheless, given continued deforestation, this may not be a given.

Changing the output mix of agriculture could be another future pathway, as long as consumers are also willing to substitute from more to less resource-intensive agri-food commodities. Clearly, the relative magnitude of these output and transformation effects is an important question for future modeling work, but some progress can be made by looking at the broad structure of incentives.

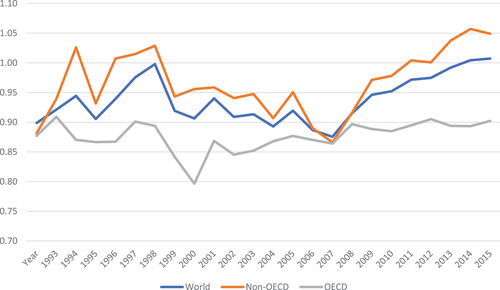

A key question that arises, given the concentration of GHG emission in the set of agricultural activities highlighted in Tables 1 and 2, is whether the current structure of agricultural support is GHG unfriendly in terms of encouraging output of these emission-intensive commodities relative to other agricultural products. A preliminary indication on this question can be obtained by comparing the rate of support for these commodities relative to other agricultural commodities. We calculate this relative incentive to produce as () where sei is the proportional support rate on emission-intensive agricultural commodities (ruminant meat, milk, rice, other cereals, pig meat, poultry meat, and eggs), and so is the support rate on other agricultural commodities. This ratio is presented in Figure 7 for the OECD, non-OECD, and the world during the 1993 to 2016 period over which agricultural support information is available for the largest countries.

Source: Authors' calculations based on FAOSTAT (accessed 3 March 2019) and OECD (2018)

[Color figure can be viewed at wileyonlinelibrary.com]Figure 7 shows that, in the early 1990s, the direct impact of global agricultural incentives slightly favors lower emission-intensive agricultural commodities, as reflected in the relative incentive ratio of 0.85 in 1993. This finding is perhaps surprising given the vertiginous rates of protection on some high emission-intensive commodities in some industrial countries during the 1980s and 1990s. In 1987, for example, the nominal rate of protection for milk in the EU was an astounding 350%.7 The relative support ratio for the OECD countries varied over the period but ended up close to its original level of 0.9. By contrast, support in non-OECD countries appears to have changed in a way that—on average—encourages output of emission-intensive goods relative to other commodities, as the relative incentive ratio increased from 0.85 to 1.05. These numbers for the direct impacts could overestimate the full impact on global emissions, however, because most of the related support was provided through trade policies, which raise consumer prices and, hence, likely have reduced demand for those goods in countries with trade barriers while they reduced output in countries without such protection and facing depressed world prices.8

The slight rise in the ratio of support to emission-intensive commodities for the world on average and for non-OECD countries is a concern, but the relatively small differential in support rates seems unlikely to be a major stimulus to output of more emission-intensive commodities. At the same time, there would seem to be a strong case for analysts and policy makers to draw attention to the existence of egregious rates of support to individual emission-intensive commodities and the adverse impacts that such support has both for the trade opportunities of other countries and for the environment.

POLICY CONDITIONALITY AND TARGETING

Thus far, our discussion of agricultural support has focused on support that affects incentives to change the level of different agricultural activities, without any direct incentive to change the production technology and particularly without any incentive to reduce emissions per unit of output. But many agricultural support schemes, such as the reformed EU Common Agricultural Policy (Gocht et al., 2017) and the US Farm Program (Lichtenberg, 2018), have involved conditionalities designed to achieve better environmental outcomes. Engel and Muller (2015) point to a wide range of approaches that might be used to improve environmental outcomes from agriculture.

There are two broad approaches to policy conditionality in farm programs: (i) paying farmers to refrain from doing something, such as plowing fragile lands (e.g., the Conservation Reserve Program in the US); and (ii) paying farmers to use farming approaches that are thought to be less environmentally damaging than their previous practices (such as the Environmental Quality Incentive Program in the US; see Engel & Muller, 2015). Frequently, the payment to refrain is implicit, with compliance to a certain minimum standard being required as a condition of eligibility for receiving another benefit, such as a price support.

Two key problems with these approaches are slippage and non-additionality. Slippage arises because participants are likely to use their discretion to minimize both the cost to them and the effectiveness of the action by, for instance, “withdrawing” land of low productivity. Non-additionality is a problem because it is difficult to avoid rewarding participants for actions they would have undertaken in any event. There is also an indirect land-use change problem. Withdrawing land from agriculture in the US may—by raising world prices—encourage conversion of land from forest to agriculture in other countries, contributing to sizeable emissions from land-use change globally. Partly because of these problems, the impacts of these conditionalities on environmental outcomes have generally been estimated to have quite modest (Gocht et al., 2017; Lichtenberg, 2018).

In an era of growing demand pressure (through income and population growth) and climate change, the necessity of protecting natural resources makes the policy environment even more critical. Many countries recognize that conservation of land and water resources is necessary to protect their long-term agricultural production potential. Tokgoz et al. (2014) summarize agricultural support allocated to environmental goals for three countries with large agricultural sectors. In 2011, the US allocated $5 billion for these programs, whereas Brazil allocated $ 1.1 billion, and China allocated $12.4 billion. Most policies that have environmental goals are part of the Green Box9 in WTO notifications, as are investments in R&D and other public-good interventions supporting agriculture, and so none of these measures is restrained by WTO limits on subsidies.

One tempting approach to managing these problems is to move to climate-smart agriculture, involving production methods that are not only more environmentally friendly than current technologies but also reduce production costs and, other things equal, increase the incomes of farmers. However, as noted by Engel and Muller (2015) approaches with these dual advantages are likely adopted even in the absence of incentives for their adoption. As they also note, however, there may be large numbers of resource-poor farmers unable to adopt if there are sizeable fixed costs of adoption, potentially leaving an important role for governments in this context.

Economists usually offer two broad approaches to managing negative externalities such as those resulting from GHG emissions. The first, originally suggested by Pigou (1932), is to impose a tax on the offending output. The second, due to Coase (1960), is to allocate property rights to the scarce resource, in this case the quantity of CO2-equivalent emissions consistent with keeping average global temperatures from rising by, say, 2°C. A closely related alternative to such a Pigovian tax is a tradable quota system such as that used to mitigate SO2 emissions in the United States (Schmalensee et al., 1998). These approaches are designed to allow polluters flexibility in the way in which they achieve the desired reductions in externalities, with a view to reducing the costs of achieving that goal. This is in sharp contrast with the more widely used command and control approaches, where policy makers seek reductions in pollution by mandating specific methods of production, such as requirements to use flue gas desulfurization (“scrubbers”) in coal-fired power plants (Schmalensee et al., 1998).

An alternative to using conditionality to achieve environmental objectives would seem to be to target payments toward activities that reduce emissions. One challenge with this approach is that—in this context—the payments are directed toward activities that raise costs of production. This would reduce their attractiveness to producers, particularly relative to decoupled payments, which obviate the need to undertake activities that yield less than their social return inherent with conventional subsidies. One possible solution to this problem would be to target such support to development of new techniques that both reduce costs and improve environmental outcomes. If, for instance, an R&D program could develop an approach to use the methane currently released through enteric fermentation to produce livestock products, then both environmental and farm-income-support goals could be improved.

ACHIEVING POLICY REFORM

Policy reform is a challenging undertaking at the best of times. This is partly due to loss aversion on the part of those losing from reform that leads them to overweight these losses relative to any potential gains and partly due to uncertainty among the potential gainers as to whether the reform will eventually occur. These interlocking challenges for reformers were clearly identified and articulated by Machiavelli (1532, 42): “And it ought to be remembered that there is nothing more difficult to take in hand, more perilous to conduct, or more uncertain in its success, then to take the lead in the introduction of a new order of things. Because the innovator has for enemies all those who have done well under the old conditions, and lukewarm defenders in those who may do well under the new.” The challenge for reformers is particularly great with a set of policies so complex and well defended as agricultural subsidies, where there are many stakeholders, many policy makers, many jurisdictions, many goals, and many different policy instruments.

Current agricultural policies can clearly be strongly criticized. Vast amounts of resources are expended on subsidies that encourage excessive production in some countries, while producers continue to be taxed in other countries. Global agriculture contributes substantially to the problem of global warming that threatens in the lifetimes of our children to compromise the world's ability to feed itself. Worse, many of the highest subsidies are used to expand the output of the more emission-intensive commodities, foods that appear to contribute strongly to increased prevalence of non-communicable diseases worldwide (Tilman & Clark, 2014). Biofuel policies ostensibly introduced to reduce emissions by replacing fossil fuels with renewable fuels in transportation end up raising food prices (Condon et al., 2015; Serra & Zilberman, 2013; Zhang et al., 2013) and likely increasing global emissions once induced land-use changes are considered (Fargione et al., 2008; Laborde & Valin, 2012; Searchinger et al., 2008).

The expansion of the biofuels sector has led to an intense food-fuel-fiber debate centering on limitations on land and water availability. Seventy percent of the world's fresh water is used for agriculture, much of it extremely wastefully. Furthermore, additional potentially arable land is limited, so there is little opportunity to expand by increasing cropped area. Thus, sustainable yield growth is the essential long-term solution to increasing food production in line with demand. Fortunately, there are many paths to increasing yields, such as use of more inputs, investments in mechanization and irrigation, better land management, agricultural R&D, and increases in cropping intensity (ERS, 2011; Laborde et al., 2016; Poudel et al., 2012). Whereas governments lavish money on subsidies whose social return is much less than one dollar per dollar invested, far too little is invested in the above channels, especially research and development where the returns per dollar spent are likely $10 or more (Alston, 2018). Unfortunately, the greater visibility of “benefits” from subsidies allows policy makers to purchase political support each electoral cycle more easily than through more productive longer term investments in R&D and rural infrastructure.

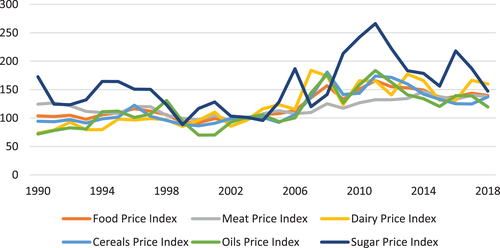

The growing demand pressure and supply constraints on world agriculture are visible in food prices. Figure 8 presents food price indices for various agricultural commodities in real terms (FAOSTAT, 2019), showing that prices have increased especially after the 2007–2008 food price crises, even in real terms. Headey and Fan (2010) provide a detailed assessment of the factors behind the food price increases.

Notes: Base year is 2002–2004 Source: FAOSTAT (2019) (accessed 2 February 2019)

[Color figure can be viewed at wileyonlinelibrary.com]Does the under investment in agricultural public goods relative to subsidies mean that policy makers are idle or misinformed, not knowing how to resolve these problems and contradictions? Of course not. Agricultural policy makers work hard at balancing the many competing pressures they face and responding to the endless shocks lashing agriculture—with climate and weather shocks looming large. Even within a country, this is as difficult and dangerous a pursuit as portrayed by Machiavelli. Dealing with problems that require internationally agreed policies is even more challenging. Key reasons for the disarray that we observe today—as in the past—are the political economy of the policy process and the cross-jurisdictional nature of many of the challenges (Johnson, 1991).

Anderson (1995) uses interest-group models originated by Olson (1971) to provide a compelling explanation for the apparent paradox of high agricultural protection in the rich countries side by side with taxation of agriculture in many developing countries. In poor countries, farmers are numerous and poorly organized. Further, many farmers are focused primarily on subsistence and not greatly affected by the level of food prices. In the same countries, the urban population is relatively small, and because incomes are low, even urban residents spend a large share of their incomes on food. Because of their proximity, urban residents can organize rapidly, particularly in response to large increases in food prices. This combination of factors tends to lead governments to favor cheap food policies.

As incomes rise, however, these features of the economy change. The farm population declines as urban centers grow. Farmers become more commercial, using more intermediate inputs and focusing more on production for the market rather than subsistence. Both these changes increase the leverage of farm prices on farmers' incomes and make them more concerned about the level of farm prices. Urban people become more numerous, making them harder to organize. Further, the increase in their incomes makes urban consumers less concerned about the impact of higher food prices on their real incomes.

This combination of changes first results in reductions in tax rates on agriculture and then increases in protection. When growth is rapid in land-scarce countries, as in China, this change can happen extremely rapidly. Political-economy models have also been shown to explain the evolution of agricultural taxation/subsidization in different countries by changing the costs to policy makers of achieving the redistributions they desire. Low-income net exporters that want lower food prices can achieve this relatively easily by imposing an export tax. Low-income net food importers would need to pay an import subsidy to achieve the same result, but this is rarely done because of the high marginal cost of public funds in poor countries. Similarly, higher income countries that want to raise food prices to protect their farmers can do so without budget cost if they are net importers. By contrast, net exporters need to pay export subsidies to increase domestic prices and tend to do this more rarely because of its budget costs.

If policies are simply determined by interest-group pressures, with stronger interest groups gaining at the expense of those less well organized, then there might appear to be no independent role for policy reform. Certainly, the importance of interest groups in policy makes policy reform more challenging. But major reforms have been achieved in some areas that initially looked daunting, such as the Uruguay Round trade agreement involving 123 members (Martin & Winters, 1996), whereas reform has been elusive in more specific areas, such as fertilizer subsidy reform in India (Birner et al., 2011). A key question is what public policy theory (see, for example, Weible et al., 2009) and the lessons of experience (e.g., Martin, 1990) can tell us about the possibilities for reforming agricultural policies in the future?

One key step for policy reformers is to frame the debate by identifying the goals that are important to key stakeholders and particularly the combination of goals to be addressed in designing a feasible reform package. A second is to identify the policy instruments that might be used to target those goals, and particularly the goals to be considered in developing a reform package. A third key design feature is the geographic scope of the reforms. A fourth is the choice of paths to reform. Each of these is addressed in turn in the remainder of this section.

Framing the debate

Perhaps the first step in framing debate on policy is to identify how the political system works and who has the power—or potential power—to change policies or to influence those who do (Mayne et al., 2018). With the key audiences identified, framing the debate in the right way is critical for successful reform (Birner et al., 2011). This involves identifying the goals—not just of the reformers but of all relevant stakeholders—and the combinations of goals to be addressed in the relevant policy reforms.

Key goals relevant for agricultural support policies are: (i) food security and nutrition, (ii) income security, and (iii) environmental sustainability.

These three goals may look simple but are, in fact, very subtle, involving many subsidiary goals, such as the Sustainable Development Goals.10 The challenge of achieving them is greatly increased by the frequency with which many stakeholders identify these goals with outcomes of limited relevance to achieving them, with the most obvious such confusion being that between food security and self-sufficiency. They are also complicated by the need to consider both levels and distribution—both across individuals and over time. Although a country may have ample food, the distribution of resources across individuals is what determines whether vulnerable people have access to food, and that access may change sharply over time (Sen, 1981).

These goals are strongly related to the more general economic goals of efficiency, equity, stability, and growth. Efficiency is a means to reduce costs and raise real incomes. Most interpretations of the equity goal involve seeking to increase food security and income security. The stability goal includes reducing the exposure of vulnerable people to even short-term food insecurity. Food security has four well-known dimensions, requiring: (i) availability of food, (ii) access to food, (iii) the ability to utilize food, and (iv) ensuring that volatility does not leave people vulnerable to food insecurity (FAO, 1996).

Each of these goals has become considerably more complex in recent years. The nutrition agenda has expanded rapidly in recent years, moving far beyond the traditional identification of malnutrition with consuming insufficient calories (FAO, 2013) to encompass concerns about micronutrient deficiencies as well as obesity and its health consequences (Babu et al., 2017). This expansion of the nutritional goal has also introduced a link between nutritional outcomes and environmental sustainability emphasized by Springmann et al. (2017), with high consumption of meats with heavy environmental footprints potentially contributing substantially to adverse global environmental outcomes. On environmental sustainability, agriculture is linked with global emissions both as a substantial contributor to emissions and through its vulnerability to climate change.

Policy instruments

Proponents of reform need to consider a wide range of policy instruments both because at least one instrument is needed for every goal, and because these additional instruments may help to break negotiating logjams. However, the complexity of policy negotiations increases more than proportionately with the number of policy instruments under discussion. A non-exhaustive list of policy instruments affecting, or potentially affecting, agricultural, environmental, and nutritional outcomes includes the following.

- Trade policy measures

- Producer subsidies and taxes

- Research, development, and extension

- Rural infrastructure

- Greenhouse gas emission taxes or quotas

- Environmental regulations

- Consumer education, food choice “nudges,” and taxes

- Biofuel policies

Note that this list includes both the subsidy measures presented in the earlier discussion (in items (i) and (ii)), and a range of other instruments that can be used to affect agricultural, environmental, and nutritional targets. Reformers need to be aware of the full range of policy instruments that might be used to target their goals, and to choose judiciously from that set of instruments when deciding how to advance policy reforms. Introducing new instruments may help to achieve goals at lower cost, although it can also complicate the policy debate by adding complexity. An important example of a new and superior policy instrument being introduced and helping facilitate reform was the US cap and trade policy for sulfur dioxide. Not only did this reduce the cost of reducing emissions relative to the previous regulatory approach of mandatory “scrubbing” of exhaust gases, but it provided opportunities to distribute valuable quotas in ways that helped facilitate acceptance of reforms (Joskow & Schmalensee, 1998). Similarly, Levy and van Wijnbergen (1995) showed that the losses to the poor associated with reducing protection to maize in Mexico following NAFTA could be mitigated, or reversed, by increasing investments in irrigation.

Application of new approaches is, however, no guarantee of success. The cap and trade mechanism that worked for reforming US policies on acid rain was not able to generate the needed support for the Kyoto Protocol. The challenges of free-riding, difficulties in communicating the need and potential effectiveness of this approach, and opposition from special interests required a move to more flexible alternatives under the Paris Agreement (UN, 2015).

The challenges involved with non-point-source pollution such as GHG from agriculture are even greater than with point-source pollution such as acid-rain from smokestacks because the individual sources of pollution are much harder to monitor and restrain. The non-point-source problem arises at the river-basin level with freshwater quality, where recommended solutions include improving nutrient use efficiency, phasing out fertilizer subsidies, and land management changes such as no-till cropping (IFPRI and Veolia, 2015).

Geographic scope of negotiations

Negotiations about policy reform may be conducted at many levels, including (i) sub-national, (ii) national, (iii) regional, and (iv) global.

The principle of subsidiarity (Follesdal, 1998) provides a useful principle that policy should be made at the lowest appropriate level. When environmental problems, for instance, are local, this allows the people best informed about the problem to make the needed decisions on managing it. Another advantage is that it avoids imposing the preferences of people not directly affected by the problem or the policy solution on those who are. Elinor Ostrom won the 2009 Nobel Prize for Economic Sciences11 by showing that local communities frequently managed natural resource problems without intervention from higher levels of government or the use of traditional economists' solutions of taxes or assignment of property rights (Ostrom, 1990).

Many environmental problems are purely national or sub-national in scope and hence amenable to solution at that level. Policy makers at those levels can use both rewards for compliance and punishments for non-compliance in a way that is generally not feasible in agreements between sovereign governments. Further, policy makers can make tradeoffs across a wide range of issues—a practice sometimes known as log-rolling—in order to secure agreement.

Policies that are attractive at national level and contribute to broader solutions have huge advantages in not requiring a cross-national consensus. However, the global impact of such policies needs to be carefully studied. Many such policies face the problem of spillovers, where reductions in emissions in one country are at least partially compensated for by increases in another (see, e.g., Koesler et al., 2016). A tax on agricultural emissions in one country, for example, reduces output, raises prices, and thereby increases output in other countries, where emission intensities may be higher.

National investments in cost-saving technologies encounter a similar problem in that reductions in the cost of the good increases demand via the so-called rebound effect (Binswanger, 2001). However, if trade is open, these improvements in productivity lower prices in the rest of the world, and reduce production there, creating a favorable spillover effect on emissions. This spillover effect will be larger again if the new technology can be adopted—whether because it is open-source or via a patent system—and increase productivity in the rest of the world. Because agricultural productivity growth has more powerful poverty-reduction impacts than productivity growth in other sectors—whether it is adopted in one or many countries—this is enormously important for economic development and poverty reduction (Ivanic & Martin, 2018). If the improvement in technology is focused on emission reduction the rebound effect will be limited because consumers do not directly gain. If this innovation can also be adopted in the rest of the world, the environmental gain will be larger again. Of course, an integrated and larger international research program would be even better, but how easy would it be to implement?

Problems that are regional, such as acid rain problems in Europe or pollution of rivers that cross national boundaries, are likely to require, or at least to benefit from, coordinated action between governments. Problems such as global warming are also likely to benefit from actions coordinated across countries, unless there are solutions that are either low cost, as appears to have been the case with the Montreal Protocol on substances that deplete the ozone layer12 or innovations that producers voluntarily choose to adopt.

Agreements at regional or global level are harder to reach than at national level and face enforcement challenges more difficult than those at national or sub-national level. Because international institutions tend to focus on vertical silos, such as the WTO for trade policy, the IMF for international macroeconomic coordination, and regional and bilateral fora for military and defense co-ordination, it is also more difficult to make trade-offs across issues.

However, addressing a problem through an international negotiation may have major advantages. One is that it becomes easier to avoid problems of free riding and hence reduces the cost to each country of achieving its goals. It may also change the set of domestic interest groups involved in a question. This is critical in trade policy, where exporters seeking reductions in partner-country tariffs become a counterweight to domestic protectionist lobbies in trade negotiations. A more-subtle advantage is that it can help manage the time inconsistency problems of sovereign governments. Under normal circumstances, a government cannot commit on behalf of its successors and so is unable to reassure investors that its reforms will endure. This can reduce investor confidence and reduce investments that depend on future policies. Committing to keep future tariffs on intermediate goods may be vitally important in attracting export-oriented investors. A trade agreement may allow such a commitment or at least increase the cost to a future government of reversing such a policy.

Paths to reform

Ideally, reform advocates would begin by identifying their goals, the instruments on which to focus, and the geographic focus of negotiations. It is possible, indeed likely, that some of these features will have been decided by others, and reformers will have opportunities to influence them only at the margin. However, once these features of the policy debate have been chosen, the remaining challenge is to convince the relevant decision makers on the right policy choice.

In an open political system, formulating a policy that is both an improvement in an economic sense and acceptable to policy makers generally requires a combination of analysis and advocacy. Analysis can help organize the information about proposals and answer questions that cannot be answered just from theory or logic, such as: Will this proposal increase national income, and by how much? Will it reduce the number of people in poverty? By how much will it reduce emissions? Analysis is more challenging but potentially more useful with partial reforms. If, for instance, a subsidy on a product that is less subsidized than average is lowered, the theory of the second best (Lipsey & Lancaster, 1956) tells us that this is likely to reduce national income, even though lowering subsidies on all commodities would raise it. Modern quantitative techniques can warn us when these problems are likely to be serious.

Analysis is particularly useful early the policy-making process, when it can help identify the potential economic gains from reform and when—hopefully—policymakers are open to influence because they have not fully committed to specific positions. Other windows of opportunity are likely to arise later in the policy process. Ideally, researchers should interact with key policy makers in advance to help ensure that their research is addressing the questions of greatest interest to policy makers and to build understanding and foster communication between researchers and policy makers. Mayne et al. (2018) describe OXFAM's process of policy campaigning as beginning with a foundational report that lays out basic analysis and recommendations. Results from analysis need to be translated into a form that can be understood by policy makers, who may not have formal training in the area. This form is likely to differ between audiences with, for example, policy makers more interested in big ideas and compelling stories, and civil servants in seeking assurance that the work is objective and rigorous (Mayne et al., 2018, Table 2).

Once the preliminary analysis to guide policy advocacy has been undertaken, reformers can move to the next stage of the process. This is widely seen as assembling advocacy coalitions (Weible et al., 2009) or discourse coalitions (Hajer, 1993), in which an understanding of policy options is forged, topics are framed in specific ways, and narratives that can communicate the essence of the problem to a broad audience developed. The establishment of a new coalition can clearly be enough of a shock to a particular policy system to create a change in policy. The formation of the Cairns Group of Agricultural Exporters during the Uruguay Round of trade negotiations is perhaps such a case (Tyers, 1993). But, as noted by Weible et al. (2009, 129), the positions of advocacy coalitions tend to be stable over time. This means that, once a set of coalitions has been formed, it may be challenging to secure continuing policy reform.

In this situation, Weible et al. (2009, 124) identify four potential paths to policy change: (i) external shocks to the policy subsystem; (ii) policy-oriented learning; (iii) internal subsystem shocks, such as observed failure of current policies; and (iv) negotiated agreements involving two or more coalitions.

Of these paths to reform, the first has ambiguous effects. Some external shocks, such as the rise in concern about global environmental impacts since the 1990s, might accelerate environmental policy reform, whereas others, such as the current enthusiasm for coal among populist leaders, may hinder it. Waiting for favorable external shocks seems no more a strategy than waiting for something to turn up during hard economic times. However, external shocks, such as crushing overall budget pressures and debt accumulation, can be a powerful stimulus to reform. The New Zealand agricultural reforms of the mid-1980s were one of the most profound examples of this, with subsidy reduction brought about partly because of a serious debt-build up and partly out of a realization that the previous policy of subsidies to expansion of the sheep flock had serious adverse environmental consequences (Vitalis, 2007). The structural adjustment programs introduced in much of the developing world in the 1980s and early 1990s in response to acute balance of payments problems frequently removed agricultural subsidies and taxes but frequently paid insufficient attention to the need for investments in public goods such as research and development (see, e.g., Commander, 1988).

Policy-oriented learning, by contrast, has enormous potential for improving policy outcomes—especially if the learning focuses on policies that are attractive to countries individually and so does not require collective action to be effective. If, for instance, ways could be found to modify enteric fermentation in ruminants so that its methane byproduct was used productively, the benefits in terms of global emission reduction could be enormous. Large reductions in emissions might also be obtained if non-leguminous plants could be modified to fix their own nitrogen from the air, obviating, or at least reducing, the need for nitrogenous fertilizers (see van Deynze et al. (2018) for some promising recent developments). Learning about demand-oriented approaches that lead to healthy diet choices could allow countries to implement nutrition programs that improve health and the environment (Springmann et al., 2017) without requiring coordination between countries.

Internal subsystem shocks are, like external shocks, ambiguous in their effects. Some shocks may create opportunities for reform, whereas others may hinder it. The apparent success of cap and trade policies in dealing with acid rain in the US encouraged interest in this policy approach, although its failure under the Kyoto protocol discourages interest in this approach, perhaps even where it might have been successful. Many internal shocks, such as budget constraints making it difficult to continue with subsidy programs, generate crises that provide important opportunities for reform. Higgs (2009) formalizes the famous policy quip “a crisis is a terrible thing to waste,”13 pointing out that many government programs, including the seminal US Agricultural Adjustment Act of 1933, involved implementing proposals that had previously been rejected. The importance of crises in policy reform makes it important that the library shelves are stocked with proposals for desirable policy reforms rather than relying on analysis undertaken on the spot, in the thick of a crisis, or on self-serving analyses generated by special interests. This crisis model of policy influence builds a case for conducting and disseminating analyses of good and important reforms, even when the prospects for immediate implementation of the proposals are not good.

CONCLUSIONS

This paper has shown that agricultural support continues to be an important source of distortions to agricultural incentives in both rich and poor countries. Protection rates have come down considerably in the rich countries, but they continue to be substantial, particularly on rice, milk, and meat products with very high emission intensities. Important progress has been made there, however, in moving away from distorting forms of support to decoupled support in developed countries. In the non-OECD countries, protection rates have gone from negative to positive, on average, although many commodities (especially cash crops) remain subject to taxation, and the average rate of protection has been strongly negative in India.

It is important to consider environmental impacts of agricultural activities and support given to agriculture because agricultural production and land use contribute a disproportionately large share of GHG emissions relative to their share in global GDP. Most emissions of greenhouse gases from agriculture are from rice, milk, and livestock commodities, with ruminant meat the most important by far. Emission intensities are substantially higher in the developing countries at this stage, but these intensities have fallen far more rapidly in developing countries than in the rich countries in the past quarter century, as agricultural productivity has increased in developing countries. However, rich countries and upper-middle income countries consume more dairy and meat products per capita than poorer countries, and these commodities have relatively higher emission intensities.

Our analysis shows that in the early 1990s, agricultural support was lower for emission-intensive goods than for other goods but now appear to be slightly biased toward emission-intensive goods. Making agricultural subsidies conditional on use of lower emission approaches is a tempting approach but appears to have had relatively little impact in the past. It seems likely that more comprehensive approaches are likely to be needed if substantial progress is to be made on subsidy reform.

Policy reform is a difficult challenge, especially in a sector such as agriculture, where special interests are accustomed to having, and exerting, substantial economic power. Some simple models of political economy would suggest that this makes reform impossible. Fortunately, there does still seem to be a role for policy reform if these constraints are recognized. Reformers need to think hard about the goals that they would like to see policies to pursue, the policy instruments they seek to change, and the geographic scope of negotiations. Once these have been identified then policy advocacy is likely to be needed, taking advantage of opportunities created by internal and external shocks, and making extensive use of analysis designed to identify policy reforms that are both feasible and welfare improving.

ACKNOWLEDGEMENTS

We wish to thank Lars Brink, Shenggen Fan, Joe Glauber, Thom Jayne, David Laborde, Rob Vos, and participants in seminars at IFPRI and the Meridian Institute for valuable comments. We alone are responsible for all remaining errors. This work was undertaken as part of the CGIAR Research Program on Policies, Institutions, and Markets (PIM) led by the International Food Policy Research Institute (IFPRI). Funding support for this study was provided by the Food and Land Use Coalition and PIM. The opinions expressed here belong to the authors and do not necessarily reflect those of PIM, IFPRI, or CGIAR.