Milk Income over Feed Cost Margin, Margin Protection Program, and Farm Finances for a Sample of Wisconsin Dairies in 2000–2017

Theodoros Skevas is an assistant professor at the Division of Applied Social Sciences at the University of Missouri. Wyatt Thompson is a professor at the Division of Applied Social Sciences at the University of Missouri. Scott Brown is an associate extension professor at the Division of Applied Social Sciences at the University of Missouri. Victor E. Cabrera is a professor and extension specialist at the Department of Dairy Science at the University of Wisconsin, Madison.

Editor in charge: Mindy Mallory

Abstract

The relationship between farm-level milk income over feed cost (IOFC) margin and national margin, profit risk, and terminal stress risk are investigated using data on Wisconsin dairy farms over the period 2000–2017. Results show that farm-specific IOFC margins were not highly correlated with the national margin, higher farm IOFC margin increased profit level and volatility but decreased downside risk, and farm terminal stress appears unaffected by either the margin or the related payments. These findings suggest that, for sample farms, a policy that targets IOFC margin might reduce downside risk of net farm income.

Introduction

A simple view of dairy farms is that they turn feed and other inputs into milk. The focus of United States dairy policy shifted to the margin between the prices of the key input and output, feed and milk, in 2014 with the introduction of the Margin Protection Program (MPP), the main domestic dairy policy until 2018. The program paid out very little through 2017, signaling either a lack of need given favorable market conditions or a missed opportunity for the policy to address difficult farm conditions. While the potential for a program that targets a key farm margin to protect farm incomes and preserve farms might make it an obvious food policy choice, it is not clear to what extent the specific mechanisms of this attempt relate to actual farm risk and exit.

We use a unique data set to estimate the relationships between the national indicators of the policy, farm-level margins, profit risk, and farm terminal stress. Results relate to policies that seek to preserve farm income and farmer well-being via the margins between output and input prices. Results find limited correlation between level and changes of national milk income over feed cost (IOFC) margins and farm-level milk receipts and feed expenses in this case. Moreover, higher IOFC margins were found to increase profit variance for the farms in our sample but were able to insulate them from downside risk exposure. Program payments were found to have no statistically significant effect on an indicator of farm financial distress that we develop, although this result might be explained by the size of payments or other aspects of program design during this time rather than the association with the margin. Results relate to US dairy policy and more broadly to other agricultural policies that seek to preserve farm income and farmer well-being via the margins between output and input prices.

Background

Farmers subscribing to MPP received a sort of insurance on this gap between milk and feed prices, subject to some caveats. Farmers producing milk would have to pay at least a nominal amount to be eligible for a payment if the margin fell below $4 per hundredweight (cwt) and could choose to pay more for up to $8 margin per cwt coverage. Payments would be made if the national margin fell below the trigger level for a two-month period. Payments were based on historical production, subject to a maximum, with this farm-level total increased according to changes in national milk production (not the dairy farm's own production) during years of participation.

The debate about this program was substantial. Topics included the use of fixed weights on feeds and national indicator prices to develop the national margin, the relationship between the calculated margin and farm risk, the two-month trigger, the upper limit on payments, and the requirement for upfront payment to participate. Some of these characteristics, like an upper limit on payment, applied at least somewhat (if not to an even greater extent) to the preceding Milk Income Loss Contract (MILC) program. Debate might have been intensified by the fact that payments under this program were well below the payments of preceding programs. The transfers associated with MPP through 2017 are estimated to be less than farmer subscription costs, resulting in a negative payment net fees for 2015–2017 from the MPP (USDA-FSA 2015, 2016, 2017, 2018; AMAP and FAPRI-MU 2018; WTO 2018a, 2018b). The new farm policy created by legislation passed and signed in 2018 replaced the MPP with the Dairy Margin Coverage (DMC) program that retains the focus on the IOFC margin (USDA-FSA 2019b). DMC retains many features of the MPP, including the reliance on payments based on national IOFC margin.

Some of the fundamental questions remain unaddressed. One of these is the relationship between the IOFC margin calculated at the national level and individual dairy farm margins and net income. The broader question is how well reduction in exposure to this margin insulates farms from financial distress and exit. This question is relevant to continuing US dairy policy and to policies that target farm output-to-input price margins more generally. However, scientific investigation into this key question is scarce.

Ideally, assessment would be able to relate the level and changes in national-level IOFC margin to the level and changes in farm-level margins, income level, and income variability over time, and even to farm exit. A survey of farmer finances, such as provided by the usually quite useful ARMS (USDA-ERS 2019), have limited time series element and do little to help understand price and income variability over time or how these map to the evolution in farm financial health and exit. An appropriate data set would track farms over time, recording their milk prices, feed costs, and indicators of the financial conditions of the farm in each year, including the period in which the MPP operated. Such data could be the basis for assessing the relationship of this policy to some of the apparent policy goals. This ideal is rarely achieved because the necessary dairy farm data are rarely available. We are aware of only one study that used farm-level data to evaluate (ex ante) performance of dairy margin policy, namely Wolf et al. (2014) who found a strong correlation between national IOFC margin and dairy farm profitability.

Applied economists lacking farm-level data have found ingenious ways to probe at the question above. Newton, Thraen, and Bozic (2015) use survey data to calibrate simulations of MPP effects as if it had been in place in an historical period before the policy was created in 2014. They decompose the effects based on farm size and price expectation formulation, finding a wide range of hypothetical net benefits from small negative amounts if up-front fees dominate payments, to hundreds of millions and even billions of dollars if using an historic year with a low margin and strong program participation. Mark et al. (2016) make a similar contribution: historical data from before the introduction of the MPP are used to estimate MPP impacts on farm income risk as though it had been in place in that time period, subject to certain assumptions, including farmer enrollment. These studies provide useful ex ante estimates of program impacts, not ex post assessment of how the calculated national margin and associated protection related to farm margins, income, risk, and exit. Counterfactual historical simulations assume that broader market conditions would be the same even with this program in place: “…the program is likely to have at least some impact on milk supply. Since changes in milk supply bring about changes in prices, the program is likely to have at least some effect on prices as well” (Mark et al. 2016, p. 9). The real question is not just how the new program would affect payments in historical market conditions, but more realistically how replacing the policies in place in that past period with the MPP would interact with subsequent market conditions to support farm income and deter exit, as intended.

Studies of farm income and exit is by no means restricted to the MPP debate, and a full discussion of this literature goes beyond the scope of this study. Indeed, a body of literature focuses on the role of off-farm activities for farm income and food security (Owusu, Abdulai, and Abdul-Rahman 2011), even though food policy of many countries might be justified at least in part by its potential effect on farm income (Tran and Goto 2019). More specifically, food policy reflects the idea that commodity prices and strategies that target these prices affect farm income (Takahashi 2012). Some important relevant studies should be kept in mind. Although not focused on the MPP, Chen, Bouchard, and Anderson (2018) consider the role of a policy—albeit a regional one—on farm exit, using hundreds of farm-level observations to do so. That said, they do not focus on the milk margin and turn to simulation rather than direct estimation of the program's impacts. Lin and Dismukes (2007) explicitly represent crop policies in terms of how they affect, even truncate, the distribution of producer receipts. Key, Prager, and Burns (2018) use ARMS data to estimate the effect of crop policies on farm income volatility. Yehouenou et al. (2018) calculate the impacts of various components of cotton policy, including crop insurance options and programs specific to this commodity, on the payouts to and certainty equivalent of producers in Texas.

This study uses a unique data set to assess the relationship between the national IOFC margin that is central to the MPP and dairy farm margin, income volatility, and terminal stress risk. Our unbalanced panel data measure Wisconsin dairy farms' prices and financial conditions from 2000 to 2017, including years with the MPP in place. Access to these data allow us to address questions fundamental to current US dairy policy and farm margin policy generally. First, how does the milk and feed price index of the MPP relate to farm-level risk associated with the margin between milk revenues and feed costs? Second, how does risk relating to the margin between milk revenues and feed costs relate to farm profit risk? The answers to these first two questions speak to the target of US dairy policies, both MPP and DMC, that focus on the margin of milk price over feed price as a means to affect farm financial stability and farm exit. Third, how does MPP affect dairy farm terminal stress? Answers to these questions can provide a better understanding of the effectiveness of MPP in reducing farm income volatility and terminal stress risk.

Methodology

Examining the Relation Between National and Farm-Level IOFC Margin

In order to examine the relation between national- and farm-level IOFC margins, the margin implied by the MPP program over the sample period was retrieved from USDA (USDA-FSA 2019a) and compared to the margin between milk receipts and feed expenses per hundredweight on two subgroups of the sample farms: those farmers that are more likely to produce their own feed (from here on referred to as feed producers) and those who are more likely to purchase most of the feed consumed by their cows (from here on referred to as feed buyers). We hypothesize that feed price risk exposure is likely higher for feed buyers, which may result in a higher correlation between their IOFC margin and the national margin. This in turn will make these farms more likely to benefit (in terms of margin risk reduction) from the introduction of MPP.

Special attention was placed on the relation between the national- and farm-level IOFC margins in the years after 2014, when the MPP was in place. If the policy margin based on national indicators is related closely to IOFC margin on these farms, then the MPP addresses this source of risk; but if the policy margin is not correlated with the IOFC margin on these farms, then the MPP does not address this source of risk for these farms.

Analyzing the Effect of IOFC Margin on Profit Risk

where π is farm operating profit (defined as total revenues less total cost of variable inputs), IOFC is the farm-level milk IOFC margin, w is a vector of production inputs (excluding variable inputs), YRt is a year dummy, γ is a vector of parameters to be estimated, ηi are unobserved farmer specific effects, and uit is the identically independently distributed error term. We use a translog function to estimate equation (1). ηi captures time invariant heterogeneity across farms, which may arise from differences in the production environment and managerial skills. The YRt dummies capture the influence of time-specific factors that are common to all farms and are not under the control of the farm (e.g. macroeconomic shocks).

For comparison purposes we also run the moment-based models while substituting milk and feed price for IOFC margin. This approach allows testing whether IOFC margin or its individual components should be the focus of interventions aiming at reducing farm profit risk.

Assessing the Effect of IOFC Margin and Other Factors on Farm Terminal Stress

Identifying the effect of IOFC margin and other factors on farm terminal stress requires developing a proxy for the latter. Given that actual farm exit data are usually unavailable (as is the case with our study), researchers have developed proxies that signal a farm in the process of exiting the sector. These proxies include farmers' exit intention (Dong et al. 2016), farmland reduction, capital disinvestment, declining profitability (Kazukauskas et al. 2013) and productivity (Sauer and Park 2009), increasing debt (Sauer and Park 2009), and lack of farm output or revenues in a given period (Pieralli, Hüttel, and Odening 2017). In accordance with the previous literature, and given data availability and theoretical considerations,2 the terminal stress proxies used in this study are as follows: (i) dynamic total factor productivity (TFP) regress in the last three years before a farm exits the sample, and (ii) disinvestment in capital assets in the last three years before a farm exits the sample. It is worth noting that farms exiting the sample may or may not have exited farming. Our terminal stress proxies do not measure actual farm exit. Instead they capture farms that are potentially about to exit the sector. Moreover, even if not terminal, the indicator is clearly a measure of persistent and serious financial distress and could at least be seen in this light. The next subsection describes the empirical strategy we follow to model the probability of a farm being under terminal stress.

Modeling the Probability of Terminal Stress

where the observed dummy Lit takes the value of one if farm i experiences dynamic TFP regress in each of its last three sample years, and zero otherwise3; the observed dummy disinvit takes the value of one if farm i disinvests in capital assets in each of its last three sample years, and zero otherwise; zi are farm-specific time-invariant variables, rit are farm-specific time-variant variables, ξ and ψ are vectors of parameters to be estimated, ηi are unobserved farm-specific heterogeneity effects (random effects), and uit is an error term.

Controlling for the effects of unobserved heterogeneity in probit models is not as straigtforward as in linear models. In the latter, unobserved heterogeneity can be controlled for by including fixed effects for each farm i. In nonlinear models, such as probit models, fixed effects estimators suffer from the incidental parameters problem, resulting in biased and inconsistent parameter estimates (Verbeek 2008). The use of random effects, however, requires the standard independence assumption (i.e. ηi are not correlated with the explanatory variables), which is a restrictive assumption in the context of our study. This is because omitted factors that contribute to fixed-effect unobserved heterogeneity, such as education and farming experience, are likely to be correlated with some of the observed explanatory factors (e.g. debt-to-asset ratio, subsidies).

Data

The data used in this study are a sample of specialized dairy farms in Wisconsin who participate in the Agriculture Financial Advisor (AgFA) program managed by the Center for Dairy Profitability at the University of Wisconsin-Madison. This program collects detailed financial and production information for Wisconsin dairy farms. The data set is an unbalanced panel that contains 7,243 observations on 776 farms, covering the period 2000–2017. On average, farms stay in the sample for nine years.

We start by describing the financial input–output data that are used to empirically specify the profit function in (1) and the dynamic TFP index which is one of the two farm terminal stress proxies used in this study (see the online supplementary material for more information on the dynamic TFP calculation). We distinguish two outputs, two variable inputs, two quasi-fixed inputs with their corresponding investments, and two fixed inputs. The two outputs are revenues from sales of milk (y1), and revenues from sales of meat and crop products (y2). The two variable inputs are feed expenses (x1), and variable costs other than feed (x2). The latter, is an aggregate variable that includes energy, contract work, veterinary expenses, crop-specific costs, and other variable input costs. The two quasi-fixed inputs are the value of buildings (K1), and machinery and equipment (K2). In line with Ang and Lansink (2017), we do not include livestock units as a separate quasi-fixed input to keep our modeling approach empirically feasible. Gross investments in quasi-fixed inputs (I) in year t are computed as the beginning value of quasi-fixed inputs in year t + 1 minus the beginning value of quasi-fixed inputs in year t plus the beginning value of depreciation in year t + 1. Fixed inputs include land (H1) and labor (H2). Land is measured in acres. Labor is measured in hours and includes both paid and unpaid hours. In line with the production literature (Serra, Lansink, and Stefanou 2011; Ang and Lansink 2017), all monetary inputs and outputs are transformed into implicit quantity indices by computing the ratio of value to its corresponding price index (i.e., they are measured at constant 2010 prices). Price indices were retrieved from the National Agricultural Statistics Service and, when necessary, aggregated to Törngvist price indexes.

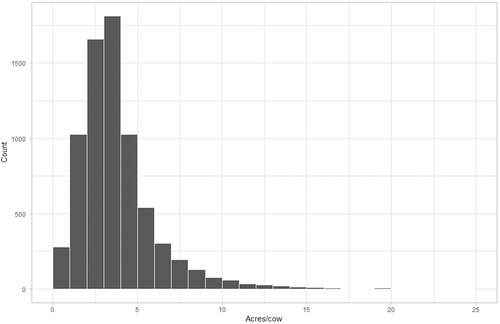

Our selection of factors (rit, zi) that may influence farm terminal stress in eq. (8) is based on the study objectives, data availability, and previous research on farm exit decisions. Milk IOFC margin is the main variable of interest included in the vector of time-varying factors (rit) 4. Milk IOFC margin is the margin between farm-level milk receipts and feed expenses, and is expressed in $/hundredweight (cwt). It is also recognized that additional factors may influence the terminal stress probability, as discussed by the farm exit literature (Kimhi and Bollman, 1999; Sauer and Park 2009; Kazukauskas et al. 2013; Dong et al. 2016; Pieralli, Hüttel, and Odening 2017). Based on this literature and the available data, rit also includes the following variables: farm size, debt-to-asset ratio, nonfarm income, subsidies, MILC and MPP payments, feed buyers and producers, and regional dummies. Following MacDonald and McBride (2009), farm size is measured as the number of cows a farm possesses at the beginning of the year—so cow numbers are exogenous to subsequent farm performance. Debt-to-asset ratio is measured as the value of debt divided by total farm assets (Skevas, Wu, and Guan 2018). Nonfarm income includes earnings from nonfarm employment. Subsidies in the data include all government payments to farms, including those relating to crop production or conservation. To proxy dairy program payments to these farms, MILC and MPP payments averaged over all US production, calculated using expenditure data (WTO 2018a, 2018b), MPP fees and eligible quantity (USDA-FSA 2019b), and historical production of the farm adjusted for changes in national production. Feed producers and buyers are dummy variables constructed based on the distribution of the ratio of land dedicated to feed production to herd size. A graph of this distribution is shown in figure 1. The first column of this graph stands out from the rest in that it represents farms with a relatively low ratio of land dedicated to feed production (i.e., pastured acres, forage acres, feed-grain acres, and other crop acres) to herd size (i.e., 0–1 acres/cow). These farms, which are defined as feed buyers, are likely to buy at least three-quarters of their feed under certain assumptions (Bellingeri et al. 2020). The rest of the farms (i.e., farms with a ratio of feed acres per cow higher than 1) are defined as feed producers, because they are more likely to produce a considerable amount of the feed used in their operations.5 Finally, regional dummies (zi) (i.e., north, south, and west central) capture the influence of unobserved regional effects such as agro-climatic factors. We recognize that the data we have available to us do not allow us to test all possible factors that could affect firm exit decisions, such as resale value of assets or indicators of the next-best investment or labor options. A descriptive summary of the data used in our study is provided in table 1. A discussion of how each variable included in rit is likely to affect farm terminal stress is presented in the supplementary material for space considerations.

Note: Feed acres are defined as the sum of pasture, forage, feed-grain, and other crop acres

| Variable | Unit | Mean | Std.dev |

|---|---|---|---|

| Milk output | $1,000* | 854.72 | 2312.90 |

| Other output | $1,000* | 60.26 | 195.55 |

| Feed | $1,000* | 240.29 | 460.03 |

| Variable inputs, except feed | $1,000* | 417.18 | 599.28 |

| Buildings | $1,000* | 272.93 | 607.02 |

| Machinery and equipment | $1,000* | 122.41 | 304.69 |

| Gross investments in buildings | $1,000* | 61.64 | 241.18 |

| Gross investments in machinery and equipment | $1,000* | 60.30 | 90.71 |

| Land | Acres | 489.42 | 412.62 |

| Labor | Hours | 8992.59 | 12908.77 |

| Milk IOFC margin | $ per hundredweight (cwt) | 12.61 | 3.24 |

| Farm size | 100 head | 1.72 | 2.51 |

| Debt-to-asset ratio | Ratio | 0.30 | 0.24 |

| Nonfarm income | $1,000 | 16.42 | 41.76 |

| MPP payments | $1,000 | −0.05 | 0.202 |

| MILC payments | $1,000 | 2.72 | 4.74 |

| Subsidies | $ per cwt | 0.75 | 0.73 |

| North | (0/1) | 0.72 | 0.45 |

| South | (0/1) | 0.20 | 0.39 |

| Central | (0/1) | 0.03 | 0.17 |

- Note: The desriptive statistics are for the full sample of 776 farms over 2000–2017 (N = 7,243). IOFC, MPP, and MILC stand for income over feed cost, margin protection program, and milk income loss contract, respectively. The asterisk superscript (*) denotes an implicit quantity index measured in constant 2010 prices.

Results

National Margin and Farm-Level Margin

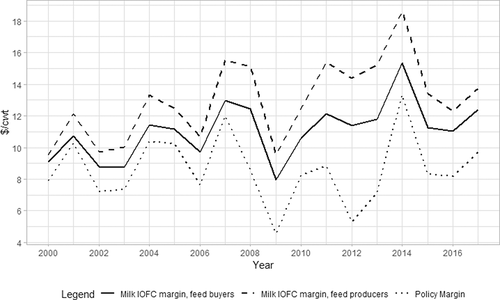

Figure 2 shows the relation between the policy margin based on national indicators and the farm-level IOFC margin of feed buyers and producers during the period 2000–2017. All margins follow a similar pattern during the sample years, including sharp declines in 2009, 2012, and 2015 when the global dairy sector suffered setbacks (IFCN Dairy Research Network, 2016) and a large peak in 2014. This peak was due to a sharp rise in milk prices and a decline in feed prices during the 2012–2014 period (IFCN Dairy Research Network, 2016). The gap between the policy margin and the farm-level margin for each farmer group is positive and appears to be widening over time. A correlation analysis for the entire sample period and for each group of farms revealed a moderate positive relationship between policy margin and farm-level margin (r = 0.52, p < 0.01 for feed buyers, and r = 0.44, p < 0.01 for feed producers). As expected, the relationship was stronger for feed buyers, reflecting a higher exposure to market feed price fluctuations. Similar results were found when analysis was restricted to the years 2015–2017, the period when the MPP was in effect (r = 0.29, p < 0.01 for feed buyers, and r = 0.15, p < 0.00 for feed producers). From 2015 on, year-over-year movements in the national margin and sample farms did not move alike. The average margin in 2016 was quite similar to the 2015 level, but margins of many sample farms deteriorated. These results were robust to changes in the ratio of feed acres per cow used to define feed buyers and producers (see figures S1 and S2 in the Supplementary Material for more details).

Note: The policy margin is based on national indicators derived from USDA (USDA-FSA 2019b) while the IOFC margin is computed using the sample data. Cwt is hundred weight

A rationale on which the MPP policy was based was that the movements in the USDA-calculated IOFC margin would be correlated with the farm-level margin. Our results likely contradict this expectation, depending on the exact threshold of correlation required, and in any case imply that the MPP addresses only a part of the risk related to the volatility of the dairy operating margin.

Margin and Profit Risk

The complete set of results of the moment function estimation is provided in tables S2 and S3 in the Supplementary Material.6 Table 2 presents the coefficients and p-values of the first-order terms of the moment function estimation of two models: a model that includes IOFC margin as a determinant of profit moments (shown in the top half of table 2 and subsequently referred to as model 1); and a model of profit moments where IOFC margin is substituted for milk and feed prices (shown in the bottom half of table 2, and subsequently referred to as model 2)7. The coefficients of the first-order terms can be interpreted as elasticities, because all variables were normalized at the sample mean. The Hausman test results (bottom of tables S2 and S3 in the Supplementary Material) confirm the selection of fixed effects estimation in the analysis of the first moment of profit.

| Mean function | Variance function | Skewness function | ||||

|---|---|---|---|---|---|---|

| Coef | p-value | Coef | p-value | Coef | p-value | |

| Model 1 | ||||||

| Capital | 0.088 | 0.656 | 0.006 | 0.001 | 0.009 | 0.001 |

| Labor | −0.369 | 0.263 | −0.064 | 0.000 | −0.095 | 0.000 |

| Land | −0.230 | 0.214 | −0.034 | 0.000 | −0.051 | 0.000 |

| Livestock | 1.828 | 0.000 | 0.437 | 0.000 | 0.656 | 0.000 |

| Milk IOFC margin | 1.102 | 0.075 | 0.263 | 0.000 | 0.394 | 0.000 |

| Model 2 | ||||||

| Capital | 0.029 | 0.850 | −0.005 | 0.020 | 0.001 | 0.788 |

| Labor | −0.582 | 0.039 | −0.072 | 0.000 | −0.124 | 0.000 |

| Land | −0.335 | 0.021 | −0.051 | 0.000 | −0.081 | 0.000 |

| Livestock | 2.299 | 0.000 | 0.520 | 0.000 | 0.777 | 0.000 |

| Milk price | 2.627 | 0.000 | 0.536 | 0.000 | 0.879 | 0.000 |

| Feed price | −2.338 | 0.000 | −0.421 | 0.000 | −0.654 | 0.000 |

- Note: The first-order term results are based on the estimation of the first three moments of the profit distribution, namely the mean, variance, and skewness. Tables S2 and S3 in the Supplementary Material show the full results of the three moment equations. IOFC stands for income over feed cost. Model 2 differs from Model 1 in that it uses milk and feed prices, instead of milk IOFC margin, as determinants of profit moments.

The results for the mean function are shown in columns 2–3 of table 2. Concerning the input elasticities of both models 1 and 2, the elasticity of the livestock input exerts a significant positive influence on mean profit. This elasticity is higher than that of the rest of the productive inputs in both models, implying that the number of dairy cows has the most significant influence on farm profitability. This was very much an expected finding; the number of dairy cows is directly related to milk production, which is the main source of revenue for the farms under investigation. Unlike model 1, in model 2 a marginal increase in labor and land decreases farm profit. The negative elasticity of labor suggests that the sample farms overused labor. The negative elasticity of land may be attributed to the fact that land is not directly related to milk production, which is the main revenue source for the sample farms, and therefore an increase in land may signal a shift to an alternative production system (e.g. crops) which contributes less to farm income. Farm-level IOFC margin in model 1 and milk price in model 2 show the expected positive first-moment effect. On the other hand, feed price in model 2 shows the expected negative first-moment effect.

The results for the variance function estimation are shown in columns 4–5 of table 2. In both models 1 and 2, capital, and livestock units are found to increase the variance of profit. Increased capital may be associated with increased investments in new machinery and farm technology. In the short run, as learning of new technologies takes place, and given differences in learning processes and capabilities among farms, farmers may experience unstable production. This result is in contrast to those of previous studies (Just and Pope 1979; Gardebroek, Chavez, and Lansink 2010; Chang and Wen 2011), which found that capital is a variance-reducing input (in the context of crop production). The variance-increasing effect of the livestock variable may be attributed to the possibility that larger farms are less risk averse and take on more risky investments (Poon and Weersink 2011). Such investments may give rise to higher returns, but will result in larger losses should they be unsuccessful. Milk IOFC margin and milk price are also among the variance-increasing factors in model 1 and 2, respectively. Higher IOFC margin and higher milk prices, which imply higher returns and financial flexibility, may lead farmers to use more debt in order to invest in new technologies (Nicholson and Stephenson 2015; Skevas, Wu, and Guan 2018). High debt is related to financial problems in many farms and may increase the variance of the rate of return on equity. This result argues against this mechanism that attempts to increase IOFC margin or milk price to decrease farm profit variance in this case.

Among the variance-reducing factors (in both models 1 and 2) are labor and land. Labor is an important input in dairy farming (Rosson 2012) and plays an important role in production risk management. A closer look at the data reveals that 64% of the total labor hours are paid or hired labor. Paid labor may be more qualified to perform specialized tasks (e.g. monitoring of the condition of cows and farm equipment) than unpaid labor (Deolalikar and Vijverberg 1987; Sabasi and Shumway 2018). This, in turn, may lead to a more effective mitigation of potential adverse production conditions. Land reduces the variance of profit perhaps by reducing financing costs and providing forage and feed resources, which may stabilize production and reduce farm costs in periods of feed shortages or high feed prices. In model 2, feed price is another variance-reducing factor. The negative effect of feed price on profit variance may suggest that, in periods of high feed prices, farmers use feed and other production inputs more carefully to avoid losses resulting from input overuse and stabilize production.

The results for the skewness function are shown in columns 6–7 of table 2. In model 1, capital, livestock units, and milk IOFC margin are positively related with profit skewness, with livestock units having the strongest effect of the three. These findings suggest that bigger (in terms of herd size), capital intensive farms, with higher margins are less prone to downside risk. The margin elasticity is lower in the variance model compared to that in the skewness model, implying a stronger effect of margin on downside risk.

Labor and land are found to have a significant negative effect on the skewness of profit (i.e., they increase downside risk). These results may be due to greater demands on limited farm-supplied labor and capital, or the lower contribution of crop income to total farm income of the sample farms, respectively, all of which can decrease profit. Similar results for the input elasticities are observed in model 2 (with the exception of the capital variable, which is insignificant). In the same model, higher milk and feed prices decrease and increase downside risk, respectively.

The Effect of IOFC Margin and Other Factors on Terminal Stress

The marginal effects of the farm terminal stress models that include the milk IOFC margin and its components as explanatory variables are presented in tables 3 and 4, respectively.8 By presenting the results in this way we can explore whether the milk IOFC margin or its components play a more important role in explaining farm terminal stress.

| Terminal stress proxy | ||||

|---|---|---|---|---|

| Dynamic TFP regress | Disinvestment | |||

| dy/dx | p-value | dy/dx | p-value | |

| Farm size | 0.011 | 0.066 | 0.015 | 0.400 |

| Farm size2 | −4.9E-04 | 0.187 | 3.2E-04 | 0.797 |

| Milk IOFC margin | 0.001 | 0.805 | −0.001 | 0.885 |

| Milk IOFC margin2 | −8.1E-06 | 0.939 | 2.2E-04 | 0.166 |

| Debt-to-asset ratio | −0.018 | 0.156 | −0.419 | 0.000 |

| Non-farm income | −1.1E-04 | 0.107 | 1.7E-04 | 0.167 |

| Subsidies | −0.004 | 0.154 | −0.025 | 0.000 |

| North | −0.015 | 0.002 | 0.113 | 0.000 |

| South | −0.001 | 0.856 | 0.118 | 0.000 |

| Feed buyers | 0.002 | 0.804 | −0.018 | 0.308 |

| Feed producers | 0.004 | 0.537 | 0.035 | 0.007 |

| MILC payments | 3.2E-07 | 0.276 | −3.3E-06 | 0.000 |

| MPP payments | −2.3E-05 | 0.000 | −1.7E-04 | 0.000 |

| Average Farm size | −0.008 | 0.158 | −0.036 | 0.182 |

| Average Farm size2 | 2.6E-04 | 0.306 | −0.001 | 0.772 |

| Average Milk IOFC margin | 0.027 | 0.113 | 0.027 | 0.148 |

| Average Milk IOFC margin2 | −0.001 | 0.112 | −0.001 | 0.123 |

| Average Debt-to-asset ratio | 0.022 | 0.146 | 0.269 | 0.000 |

| Average Non-farm income | 1.3E-04 | 0.171 | −0.001 | 0.019 |

| Average Subsidies | 0.011 | 0.175 | 0.069 | 0.002 |

| Average Feed buyers | −0.031 | 0.198 | 0.118 | 0.009 |

| Average Feed producers | −0.044 | 0.029 | −0.092 | 0.013 |

| Average MILC payments | 2.2E-04 | 0.005 | 0.001 | 0.000 |

| Average MPP payments | −2.0E-06 | 0.236 | 1.0E-05 | 0.062 |

- Note: Marginal effects for continuous variables are evaluated at the sample means whereas those for discrete variables are evaluated as a change in the variable from 0 to 1, holding all other variables fixed at their means.

| Terminal stress proxy | ||||

|---|---|---|---|---|

| Dynamic TFP regress | Disinvestment | |||

| dy/dx | p-value | dy/dx | p-value | |

| Farm size | 0.012 | 0.048 | −0.006 | 0.722 |

| Farm size2 | −0.001 | 0.169 | 0.001 | 0.226 |

| Milk price | 0.003 | 0.304 | 0.007 | 0.003 |

| Feed price | 0.008 | 0.035 | 0.017 | 0.003 |

| Milk price2 | −5.8E-05 | 0.400 | -7E-05 | 0.170 |

| Feed price2 | −0.001 | 0.033 | −4.5E-04 | 0.267 |

| Debt-to-asset ratio | −0.014 | 0.259 | −0.399 | 0.000 |

| Non-farm income | −1.1E-04 | 0.100 | 1.6E-04 | 0.193 |

| Subsidies | −0.002 | 0.377 | −0.021 | 0.000 |

| North | −0.014 | 0.002 | 0.108 | 0.000 |

| South | 0.001 | 0.893 | 0.116 | 0.000 |

| Feed buyers | 0.001 | 0.934 | −0.021 | 0.236 |

| Feed producers | 0.004 | 0.523 | 0.033 | 0.010 |

| MILC payments | 4.0E-07 | 0.151 | -3E-06 | 0.000 |

| MPP payments | −2.2E-05 | 0.000 | −1.7E-04 | 0.000 |

| Average Farm size | −0.009 | 0.135 | −0.001 | 0.979 |

| Average Farm size2 | 2.8E-04 | 0.257 | −0.003 | 0.300 |

| Average milk price | −0.002 | 0.157 | −0.003 | 0.617 |

| Average feed price | −0.010 | 0.034 | −0.065 | 0.000 |

| Average milk price2 | 1.7E-06 | 0.073 | −3.3E-05 | 0.551 |

| Average feed price2 | 0.001 | 0.029 | 0.004 | 0.007 |

| Average Debt-to-asset ratio | 0.016 | 0.285 | 0.264 | 0.000 |

| Average Non-farm income | 9.0E-05 | 0.403 | −0.001 | 0.023 |

| Average Subsidies | 0.008 | 0.322 | 0.050 | 0.029 |

| Average Feed buyers | −0.032 | 0.192 | 0.103 | 0.022 |

| Average Feed producers | −0.043 | 0.026 | −0.083 | 0.022 |

| Average MILC payments | 1.9E-04 | 0.012 | 0.001 | 0.000 |

| Average MPP payments | −2.1E-06 | 0.193 | 8.0E-06 | 0.157 |

- Note: Marginal effects for continuous variables are evaluated at the sample means whereas those for discrete variables are evaluated as a change in the variable from 0 to 1, holding all other variables fixed at their means.

Notice that the marginal effects of the variables other than the milk IOFC margin and its components differ only slightly between the two modeling frameworks. Hence the interpretation of these marginal effects (in terms of the direction of the effects) applies to both the models presented in tables 3 and 4.

The coefficient of farm size was found to be positive and statistically significant (at the 10% level) in one out of the two models tested (i.e., in the dynamic TFP regress model). More specifically, the associated increase in the terminal stress probability is about 1% for every one hundred head increase in cow numbers. This finding is in contrast with those of Dong et al. (2016) and Kimhi and Bollman (1999) for US dairy and Canadian family farm exit decisions, respectively. Large farmers (in terms of average head size) may be more able to take more risk by investing in high risk, high (expected) return assets (Poon and Weersink 2011). If large unexpected losses occur during economic downturns, then these farmers may be forced to wind down their operations or exit the sector. The finding that an increase in farm size increases the probability of terminal stress may also reflect the fact that where economies of scale occur across the dairy industry, it increases the probability that financially stressed9 farms wind down their operations and sell to other dairies.

Moving to the effect of IOFC margin on terminal stress (table 3), the results suggest that this variable has an insignificant effect on terminal stress probability. Concerning the effect of milk price on terminal stress (table 4), the results show that an increase in milk price by one unit increases the terminal stress probability by 0.7% (just in the model where terminal stress is proxied by disinvestment). One likely explanation for this finding is that higher milk prices could induce riskier investment and consequently increase business risk. Another possible explanation is that the monetizable value of the dairy herd increases as a result of high milk prices, causing more farms (especially those with financial difficulties) to wind down their operations and sell to other dairies. Moving to the effect of feed price on terminal stress, table 4 shows that higher feed prices increase farm terminal stress probability at a decreasing rate. More specifically, the associated decrease in probability ranges from 0.8% to 1.7%. This is likely because high feed prices decrease the amount available to pay for other expenses such as capital and labor.

Debt-to-asset ratio has a negative significant impact on the terminal stress probability (just in the model where terminal stress is proxied by continuous disinvestment10). That is, a one-unit rise in debt relative to total assets leads to a fall in the terminal stress probability by approximately 40%. One possible explanation for this finding may be that the higher debt is related to increased farm investments in new technology or infrastructure, and is thus part of a larger strategy to stay in business and prosper.

Higher subsidies decrease the probability of a farm being under terminal stress, a result that is consistent in one out of the two models tested. The associated decrease in probability ranges from 2.1% to 2.5%. An explanation is that subsidies supplement farm income (Goetz and Debertin 2001) and reduce the cost of external finance (Key and Roberts 2006), thus allowing farmers to invest in new technologies and increase their competitiveness. Higher subsidies may also reduce farmers' incentive to wind down their operation by making farming more economically rewarding than alternative off-farm employment.

The results of the regional dummies show significant coefficients, implying the presence of significant regional heterogeneity in farm terminal stress probability. More specifically, the terminal stress probability is significantly higher in the north and south region than in the west central region, in the model where terminal stress is proxied by disinvestment. When using dynamic TFP regress as a proxy for terminal stress we find that farms operating in the north region of the state exhibit lower terminal stress probability than farms operating in the west central region. Farmers that produce a large amount of feed relatively to their herd size have a higher terminal stress probability (in the model where terminal stress is proxied by disinvestment). This result is robust to changes in the definition of feed buyers and producers using higher ratios of feed acres to number of cows (i.e., 1.5 and 2 acres/cow). An explanation for this finding may be that these farmers are in the process of moving from dairy to crop farming. However, this explanation should be tested empirically in future research.

Moving to the effect of the MPP and MILC payments on terminal stress, the results show that both payments have a negative effect on terminal stress probability, although this result is economically insignificant, meaning that, on average, these payments were not able to insulate the sample farms against terminal or financial distress. This finding was expected, especially for MPP payments, as MPP made few payments during the 2015–2017 period (e.g., MPP payments totaled only $25 million in 2015 (USDA-OCFO 2015)).

Finally, a considerable number of the means of the time-varying covariates are statistically significant (mostly in the model where terminal stress is proxied by disinvestment), implying that unobserved heterogeneity plays a role in driving the terminal stress probability. Note that the coefficients of the means of the time-varying variables are of no direct interest since these variables are only included to control for the effects of unobserved heterogeneity (Denny and Doyle 2009).

Conclusions

This study employs an unbalanced panel data set of 776 Wisconsin dairy farms observed over the period 2000–2017 to assess the relationship between national IOFC margin that is central to the MPP and dairy farm margin. It further examines the effect of farm margin on profit variance and skewness and the likelihood of farms being under terminal stress. Terminal stress is proxied by indicators based on dynamic productivity regress, and disinvestment in capital assets. Estimates relate to US dairy policy that focuses on the margin between milk price and feed price in two ways: first, by testing the causes of this price margin and how it relates to farm financial and existential risk; and, second, by testing whether the MPP itself had an impact on these outcomes in this sample.

Results show that the IOFC margin of the sample farms is moderately related to the national margin, implying that the MPP design mitigated only a part of the risk associated with the volatility of the dairy operating margin for the sample farms. This finding might contradict the expectation on which the MPP policy was based, namely that the farm-level margin would be strongly correlated with the nationally calculated IOFC margin. We cannot judge how much of a national-farm relationship is enough, and we do not seek here to identify alternative indicators of price stress that can be gathered quickly and used as a basis for policy action. While we do not assert that there are better alternatives, this policy that provided payments based on this national indicator of farm financial stress seems not to have been very well timed to help farmers in this sample when price conditions were most dire.

We further find that higher farm IOFC margin increases profit variance but reduces downside risk exposure (by increasing the skewness of profit). The finding that downside profit risk falls if the farm IOFC margin rises appears to relate to a key mechanism of current US dairy policy. In particular the focus of margin protection policies or more specifically the lower values of these margins might have an impact on downside profit risk of dairy farms.

The results of the terminal stress analysis show that the IOFC margin did not affect the likelihood of the farms in this sample experiencing terminal stress. In contrast, we find that higher feed prices increased the likelihood of sample farms experiencing terminal stress and MPP payments had an inconsequential effect on terminal stress risk. This latter finding was expected since MPP made few payments during the sample period. Taken together, these results imply that the mechanisms of the MPP might be appropriately targeted for the farms in this sample if the goal is to reduce downside risk exposure (e.g. the likelihood of experiencing negative farm profits) and consequently also reduce terminal stress risk.

With respect to other factors that affect farm terminal stress, we found that larger farms and farms that produce a large amount of feed relatively to their herd size are more likely to experience farm terminal stress, while the opposite is true for more indebted farms and farms that receive high government payments. We should emphasize again that these findings apply only to the sample at hand and should not be generalized to the wider Wisconsin dairy farm population without additional testing.

In summary, this research provides a first step toward understanding the relationship between the national IOFC margin that is central to the MPP and dairy farm margin, profit volatility and downside risk, and terminal stress; however, it has some limitations that can be addressed in future studies. For instance with regard to the empirical estimation, the analysis of dairy farms that entirely quit farming would be desirable. Moreover, farm-level data on actual MPP payments will allow to better quantify the effect of MPP on farm profit volatility and farm survival.

Acknowledgments

The authors are grateful to the University of Wisconsin Center for Dairy Profitability (http://cdp.wisc.edu/), especially Jenny Vanderlin, for providing the data used to perform the present study. “This work is supported by the Hatch Multi-State Research Program project accession no. 1015805 from the USDA National Institute of Food and Agriculture.”

References

- 1 Downside risk means exposure to unanticipated low outcomes (e.g. negative profit).

- 2 For example, as a reviewer noted, increasing debt may not be a good indicator of terminal stress risk or exit because more leveraged farms could have taken more debt to finance growth opportunities and/or update their technology (e.g. machinery and equipment).

- 3 For a detailed explanation of how dynamic TFP was constructed, see the online supplementary material.

- 4 To assess whether the dairy margin or its components play a role in farm terminal stress, eq. (8) was estimated after replacing IOFC margin with its individual components (i.e. milk and feed price).

- 5 We checked that our results are robust with respect to this choice by using ratios of 1.5 and 2 to define feed buyers.

- 6 Following Sauer and Park (2009) we tested the effect of profit shifters, namely debt-to-asset ratio, nonfarm income, and climatic variables, on profit mean and variance. These effects were found to be insignificant, did not improve model fit, and were dropped from the models.

- 7 An aggregate capital variable, which is the sum of the buildings and machinery and equipment variables, was used in the estimation of the moment functions. This was done in order to be in line with the existing literature which estimates farm profit functions (e.g. Skevas, Wu, and Guan, 2018) and to reduce the number of estimated coefficients to a minimum in order to facilitate a robust estimation. As a robustness check we also ran the moment functions using the disaggregated capital components, but the results did not change substantively and there was no improvement in model fit.

- 8 The coefficients of the probit models are not reported here, but are available from the authors upon request.

- 9 Our data show that the relatively large sample farms (i.e. those in the 4th quartile of the farm size variable), are, on average, the least profitable (on a per cow basis) farms in the sample, and are thus more likely to experience financial stress.

- 10 To account for the fact that very small disinvestments in capital assets are unlikely to signal a decision to exit farming, we have considered two alternative terminal stress proxies based on disinvestment in capital assets. The two proxies were based on disinvestment of at least 10% and 20% of initial capital, respectively. Our main results were robust to these changes.